Question: Consider a 2-period binomial model with an initial stock price of $150. Suppose during each of the 2 periods, the stock can either go up

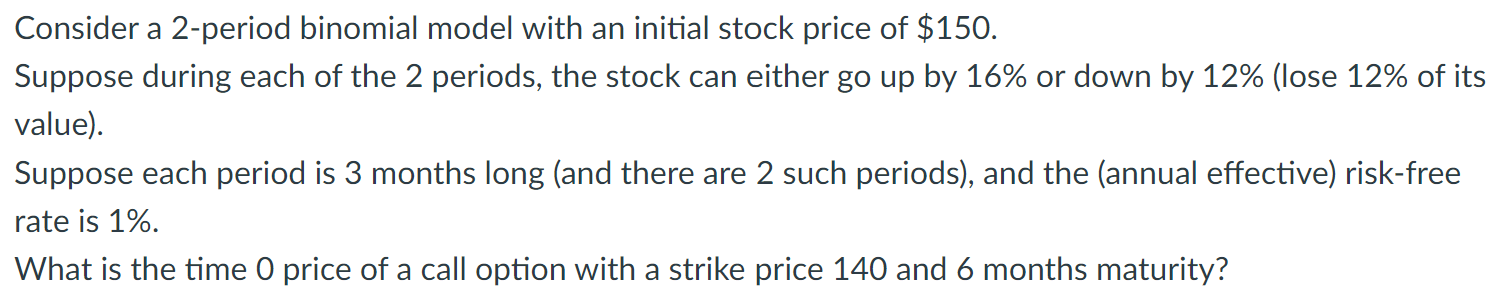

Consider a 2-period binomial model with an initial stock price of $150. Suppose during each of the 2 periods, the stock can either go up by 16% or down by 12% (lose 12% of its value). Suppose each period is 3 months long (and there are 2 such periods), and the (annual effective) risk-free rate is 1%. What is the time O price of a call option with a strike price 140 and 6 months maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts