Question: Consider a 2-period overlapping generations model. There are infinitely many identical firms that use capital and labor to produce the only consumption good of the

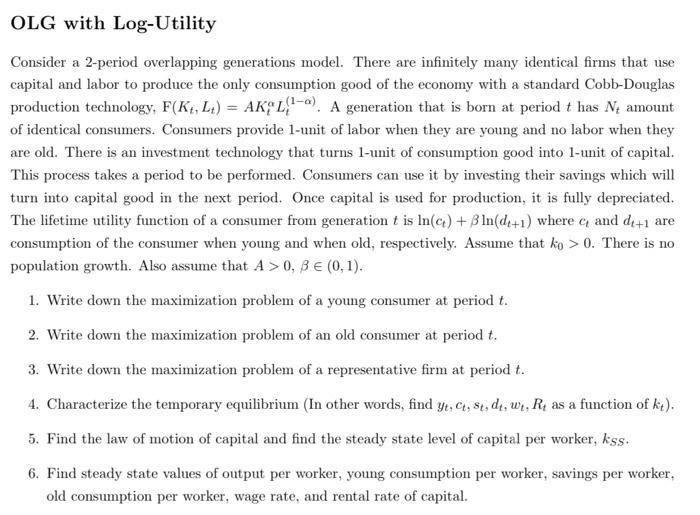

Consider a 2-period overlapping generations model. There are infinitely many identical firms that use capital and labor to produce the only consumption good of the economy with a standard Cobb-Douglas production technology, F(Kt,Lt)=AKtLt(1). A generation that is born at period t has Nt amount of identical consumers. Consumers provide 1-unit of labor when they are young and no labor when they are old. There is an investment technology that turns 1-unit of consumption good into 1-unit of capital. This process takes a period to be performed. Consumers can use it by investing their savings which will turn into capital good in the next period. Once capital is used for production, it is fully depreciated. The lifetime utility function of a consumer from generation t is ln(ct)+ln(dt+1) where ct and dt+1 are consumption of the consumer when young and when old, respectively. Assume that k0>0. There is no population growth. Also assume that A>0,(0,1). 1. Write down the maximization problem of a young consumer at period t. 2. Write down the maximization problem of an old consumer at period t. 3. Write down the maximization problem of a representative firm at period t. 4. Characterize the temporary equilibrium (In other words, find yt,ct,st,dt,wt,Rt as a function of kt ). 5. Find the law of motion of capital and find the steady state level of capital per worker, kSS. 6. Find steady state values of output per worker, young consumption per worker, savings per worker, old consumption per worker, wage rate, and rental rate of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts