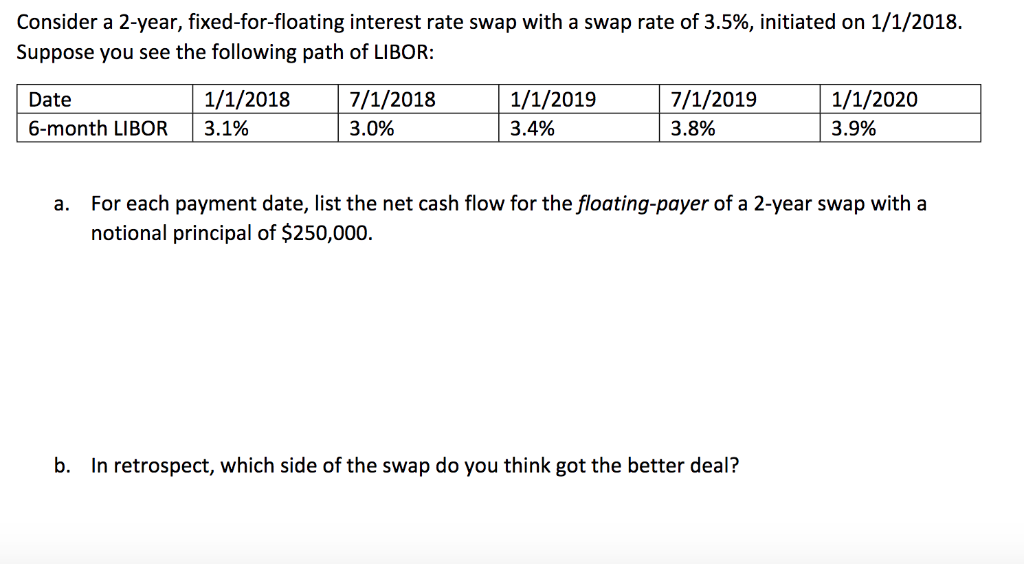

Question: Consider a 2-year, fixed-for-floating interest rate swap with a swap rate of 3.5%, initiated on 1/1/2018. Suppose you see the following path of LIBOR: 1/1/20187/1/2018

Consider a 2-year, fixed-for-floating interest rate swap with a swap rate of 3.5%, initiated on 1/1/2018. Suppose you see the following path of LIBOR: 1/1/20187/1/2018 1/1/2019 3.4% 7/1/2019 3.8% 1/1/2020 3.9% Date 6-month LIBOR | 3.1% 3.0% For each payment date, list the net cash flow for the floating-payer of a 2-year swap with a notional principal of $250,000. a. b. In retrospect, which side of the swap do you think got the better deal

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock