Question: Consider a 2-year zero-coupon corporate bond which will default with probability 0.7%. In the event of default, there is a 60% chance bondholders will recoup

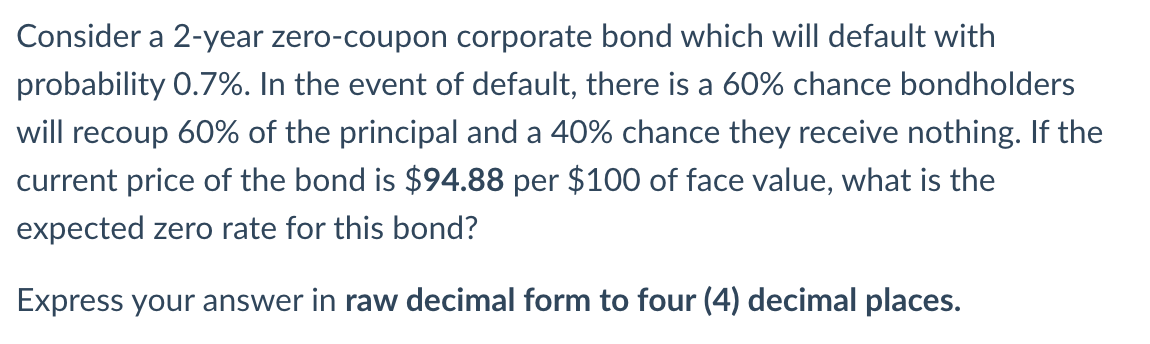

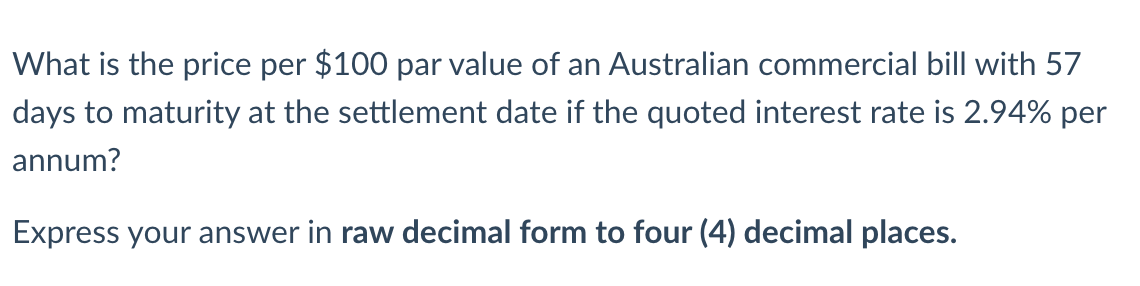

Consider a 2-year zero-coupon corporate bond which will default with probability 0.7%. In the event of default, there is a 60% chance bondholders will recoup 60% of the principal and a 40% chance they receive nothing. If the current price of the bond is $94.88 per $100 of face value, what is the expected zero rate for this bond? Express your answer in raw decimal form to four (4) decimal places. What is the price per $100 par value of an Australian commercial bill with 57 days to maturity at the settlement date if the quoted interest rate is 2.94% per annum? Express your answer in raw decimal form to four (4) decimal places. Consider a 2-year zero-coupon corporate bond which will default with probability 0.7%. In the event of default, there is a 60% chance bondholders will recoup 60% of the principal and a 40% chance they receive nothing. If the current price of the bond is $94.88 per $100 of face value, what is the expected zero rate for this bond? Express your answer in raw decimal form to four (4) decimal places. What is the price per $100 par value of an Australian commercial bill with 57 days to maturity at the settlement date if the quoted interest rate is 2.94% per annum? Express your answer in raw decimal form to four (4) decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts