Consider a 3-year semi-annual coupon paying bond issued on January 1, 2022 with a coupon rate...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

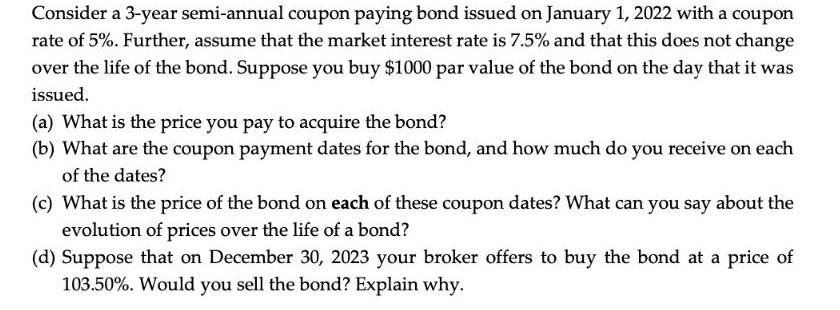

Consider a 3-year semi-annual coupon paying bond issued on January 1, 2022 with a coupon rate of 5%. Further, assume that the market interest rate is 7.5% and that this does not change over the life of the bond. Suppose you buy $1000 par value of the bond on the day that it was issued. (a) What is the price you pay to acquire the bond? (b) What are the coupon payment dates for the bond, and how much do you receive on each of the dates? (c) What is the price of the bond on each of these coupon dates? What can you say about the evolution of prices over the life of a bond? (d) Suppose that on December 30, 2023 your broker offers to buy the bond at a price of 103.50%. Would you sell the bond? Explain why. Consider a 3-year semi-annual coupon paying bond issued on January 1, 2022 with a coupon rate of 5%. Further, assume that the market interest rate is 7.5% and that this does not change over the life of the bond. Suppose you buy $1000 par value of the bond on the day that it was issued. (a) What is the price you pay to acquire the bond? (b) What are the coupon payment dates for the bond, and how much do you receive on each of the dates? (c) What is the price of the bond on each of these coupon dates? What can you say about the evolution of prices over the life of a bond? (d) Suppose that on December 30, 2023 your broker offers to buy the bond at a price of 103.50%. Would you sell the bond? Explain why.

Expert Answer:

Answer rating: 100% (QA)

a To calculate the price you pay to acquire the bond you need to calculate the present value of its future cash flows including both the coupon paymen... View the full answer

Related Book For

Financial Reporting and Analysis

ISBN: 978-1259722653

7th edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

Posted Date:

Students also viewed these accounting questions

-

The following information is available for ADT Company, which produces special-order security products and uses a job order costing system. Overhead is applied using a predetermined overhead rate of...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

2. Evaluate the following definite integrals (a) (2x - 6x) dx /6 (b) 16 cos 3t + 2 sin 3t dt x+1 2 da

-

During early November 2009, the threat of H1N1 and the fact that the vaccines were initially in short supply resulted in Public Health Agency' of Canada prioritizing the people who would receive the...

-

Use truth tables to determine the validity or invalidity of each of the following arguments: (P 1 ): K L (P 2 ): K ~ L

-

2. The encumbrance account of a governmental unit is debited when: a The budget is recorded b A purchase order is approved c Goods are received d A voucher payable is recorded

-

Tulip Company is made up of two divisions: A and B. Division A produces a widget that Division B uses in the production of its product. Variable cost per widget is $0.75; full cost is $1.00....

-

Calculate the percentage difference between the final value and the present value of a 2-term income, where 18% is the interest rate.

-

This problem continues the Draper Consulting, Inc., situation from Problem 2-62 of Chapter 2. Start from the trial balance and the posted T-accounts that Draper Consulting, Inc., prepared at December...

-

Looking at business fixed investment, explain why investment is negatively related to the interest rates.

-

Assume an organic compound has a partition coefficient between water and ethyl acetate equal to 8.12. If there are initially 7.10 grams of the compound dissolved in 75.0 mL of water, how many grams...

-

Berger Paint Pakistan limited produces three types of joint products, S ilver paint, G olden paint and D iamond paint. During March, 2020, the following information was recorded : Particulars Silver...

-

Choose an industry in which you are interested in working. How is that industry trending? What internal and external factors may affect the direction of the organization? For your initial post,...

-

show all work and Computations and if favorable or unfavorable. Standard Cost Data per 1 Unit Quantity Price Direct Labor 2 hrs $4.00/hr Actual Data: Units produced 20 20 Direct Labor 30 hrs; total...

-

4. A petroleum company is considering the expansion of its one unloading facility at its Australian refinery. Due to random variations in weather, loading delays, and other factors, ships arriving at...

-

Compute Topp Company's price-earnings ratio if its common stock has a market value of $24.57 per share and its EPS is $4.20. Considering Lower deck, its key competitor, has a PE ratio of 9.5, which...

-

What is an access control list?

-

Jeanette Corporations president is in a dilemma regarding which inventory method (LIFO or FIFO) to use. The controller provides the following list of factors that should be considered before making a...

-

Whole Foods Market's Compensation Committee determines a portion of executive bonuses qualitatively. For the quantitative portion, the Committee selects from 13 performance metrics. For the fiscal...

-

Hestor Company's records indicate the following information: Merchandise inventory, January 1, 2017.............................................$ 550,000 Purchases, January 1 through December 31,...

-

33. On January 1,2008, a rich citizen of the Town of Ristoni donates a painting valued at $300,000 to be displayed to the public in a government building. Although this painting meets the three...

-

31. The City of Lawrence opens a solid waste landfill in 2008 that is at 54 percent of capacity on December 31, 2008. The city had initially anticipated closure costs of $2 million but later that...

-

29. On January 1, 2008, the City ofVerga leased a large truck for five years and made the initial annual payment of $22,000 immediately. The present value of these payments based on an 8 percent...

Study smarter with the SolutionInn App