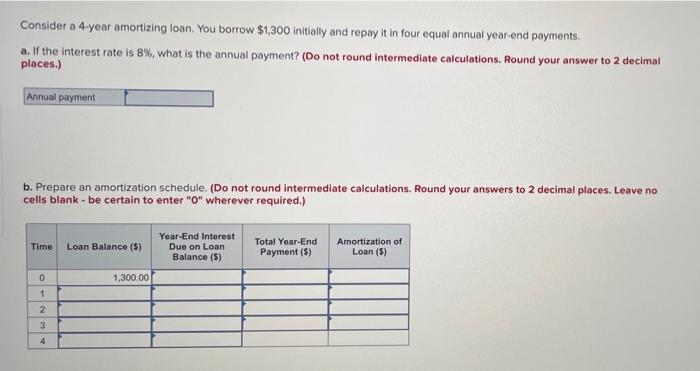

Question: Consider a 4-year amortizing loan. You borrow $1,300 initially and repay it in four equal onnual year-end payments. a. If the interest rate is 8%,

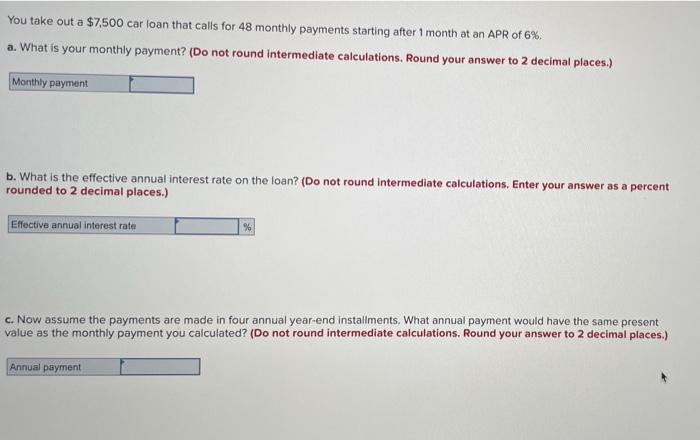

Consider a 4-year amortizing loan. You borrow $1,300 initially and repay it in four equal onnual year-end payments. a. If the interest rate is 8%, what is the annual payment? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Annual payment b. Prepare an amortization schedule. (Do not round intermediate calculations. Round your answers to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required.) Time Loan Balance (5) Year-End Interest Due on Loan Balance (5) Total Year-End Payment (S) Amortization of Loan (S) 0 1,300.00 1 2 3 4 You take out a $7,500 car loan that calls for 48 monthly payments starting after 1 month at an APR of 6%. a. What is your monthly payment? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Monthly payment b. What is the effective annual interest rate on the loan? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Effective annual interest rate % c. Now assume the payments are made in four annual year-end installments. What annual payment would have the same present value as the monthly payment you calculated? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Annual payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts