Question: Consider a 4-year amortizing loan. You borrow $469,000 initially, and repay it in four equal annual year-end payments. a. If the interest rate is 7.6%,

| Consider a 4-year amortizing loan. You borrow $469,000 initially, and repay it in four equal annual year-end payments. |

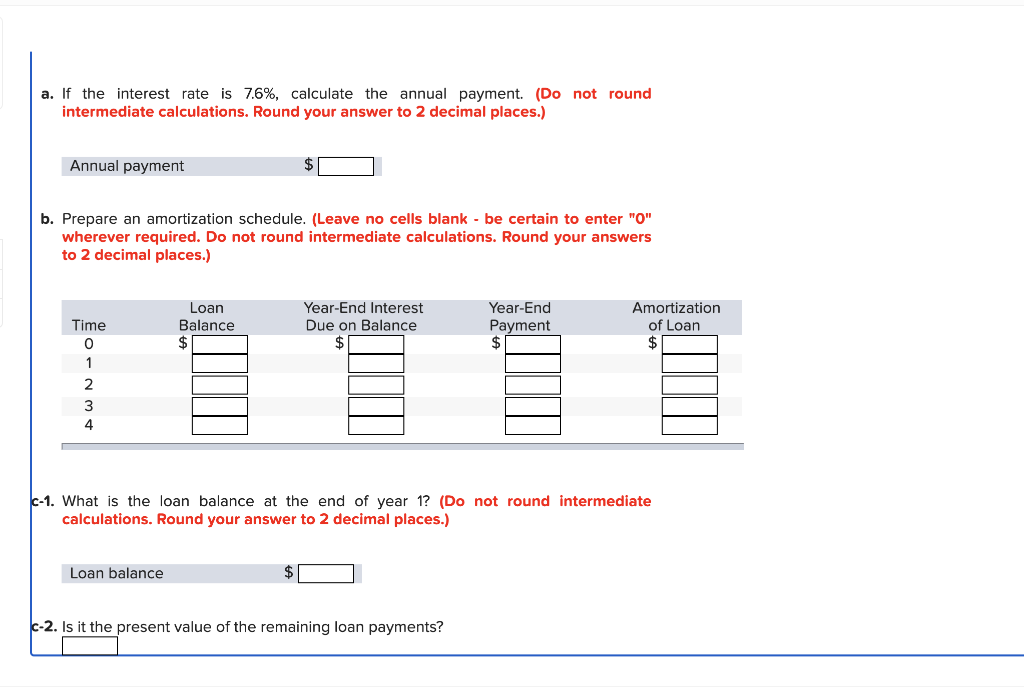

| a. | If the interest rate is 7.6%, calculate the annual payment. (Do not round intermediate calculations. Round your answer to 2 decimal places.) |

| Annual payment | $ |

| b. | Prepare an amortization schedule. (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Round your answers to 2 decimal places.) |

| Time | Loan Balance | Year-End Interest Due on Balance | Year-End Payment | Amortization of Loan | ||||||||

| 0 | $ | $ | $ | $ | ||||||||

| 1 | ||||||||||||

| 2 | ||||||||||||

| 3 | ||||||||||||

| 4 | ||||||||||||

| c-1. | What is the loan balance at the end of year 1? (Do not round intermediate calculations. Round your answer to 2 decimal places.) |

| Loan balance | $ |

| c-2. | Is it the present value of the remaining loan payments? |

a. If the interest rate is 7.6%, calculate the annual payment. (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. Prepare an amortization schedule. (Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Round your answers to 2 decimal places.) -1. What is the loan balance at the end of year 1? (Do not round intermediate calculations. Round your answer to 2 decimal places.) -2. Is it the present value of the remaining loan payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts