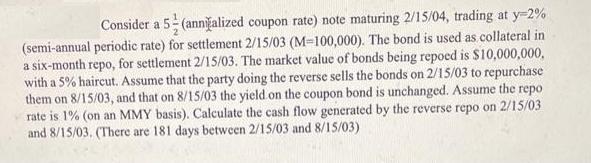

Question: Consider a 5 (annalized coupon rate) note maturing 2/15/04, trading at y-2% (semi-annual periodic rate) for settlement 2/15/03 (M-100,000). The bond is used as

Consider a 5 (annalized coupon rate) note maturing 2/15/04, trading at y-2% (semi-annual periodic rate) for settlement 2/15/03 (M-100,000). The bond is used as collateral in a six-month repo, for settlement 2/15/03. The market value of bonds being repoed is $10,000,000, with a 5% haircut. Assume that the party doing the reverse sells the bonds on 2/15/03 to repurchase them on 8/15/03, and that on 8/15/03 the yield on the coupon bond is unchanged. Assume the repo rate is 1% (on an MMY basis). Calculate the cash flow generated by the reverse repo on 2/15/03 and 8/15/03. (There are 181 days between 2/15/03 and 8/15/03)

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Calculate the cash flow generated by the reverse repo on 21503 and 81503 Where Market value of bonds ... View full answer

Get step-by-step solutions from verified subject matter experts