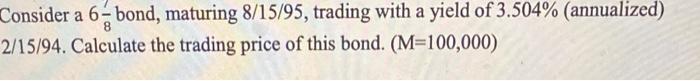

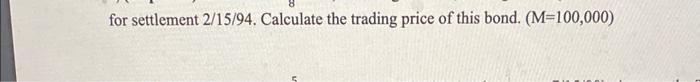

Question: Consider a 681 bond, maturing 8/15/95, trading with a yield of 3.504% (annualized) 2/15/94. Calculate the trading price of this bond. (M=100,000) for settlement 2/15/94.

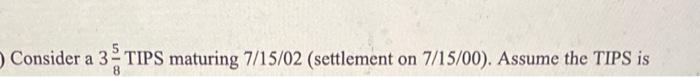

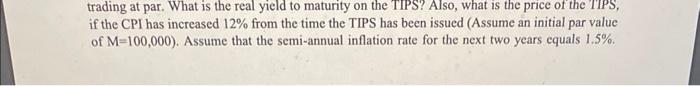

Consider a 681 bond, maturing 8/15/95, trading with a yield of 3.504% (annualized) 2/15/94. Calculate the trading price of this bond. (M=100,000) for settlement 2/15/94. Calculate the trading price of this bond. (M=100,000) Consider a 385 TIPS maturing 7/15/02 (settlement on 7/15/00 ). Assume the TIPS is trading at par. What is the real yield to maturity on the TIPS? Also, what is the price of the TIPS, if the CPI has increased 12% from the time the TIPS has been issued (Assume an initial par value of M=100,000 ). Assume that the semi-annual inflation rate for the next two years equals 1.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts