Question: Consider a bank with a positive repricing gap using a 6-month planning period. Choose the most correct statement a. If all interest rates are expected

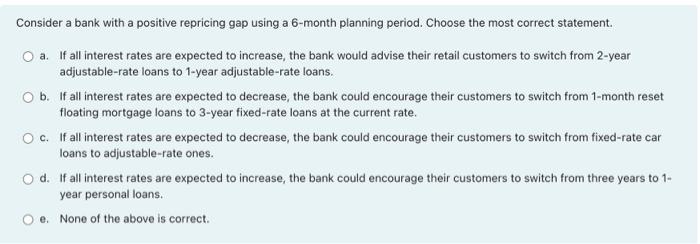

Consider a bank with a positive repricing gap using a 6-month planning period. Choose the most correct statement a. If all interest rates are expected to increase, the bank would advise their retail customers to switch from 2-year adjustable-rate loans to 1-year adjustable-rate loans. O b. If all interest rates are expected to decrease, the bank could encourage their customers to switch from 1-month reset floating mortgage loans to 3-year fixed-rate loans at the current rate. Oc. If all interest rates are expected to decrease, the bank could encourage their customers to switch from fixed-rate car loans to adjustable-rate ones. Od. If all interest rates are expected to increase, the bank could encourage their customers to switch from three years to 1- year personal loans. e None of the above is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts