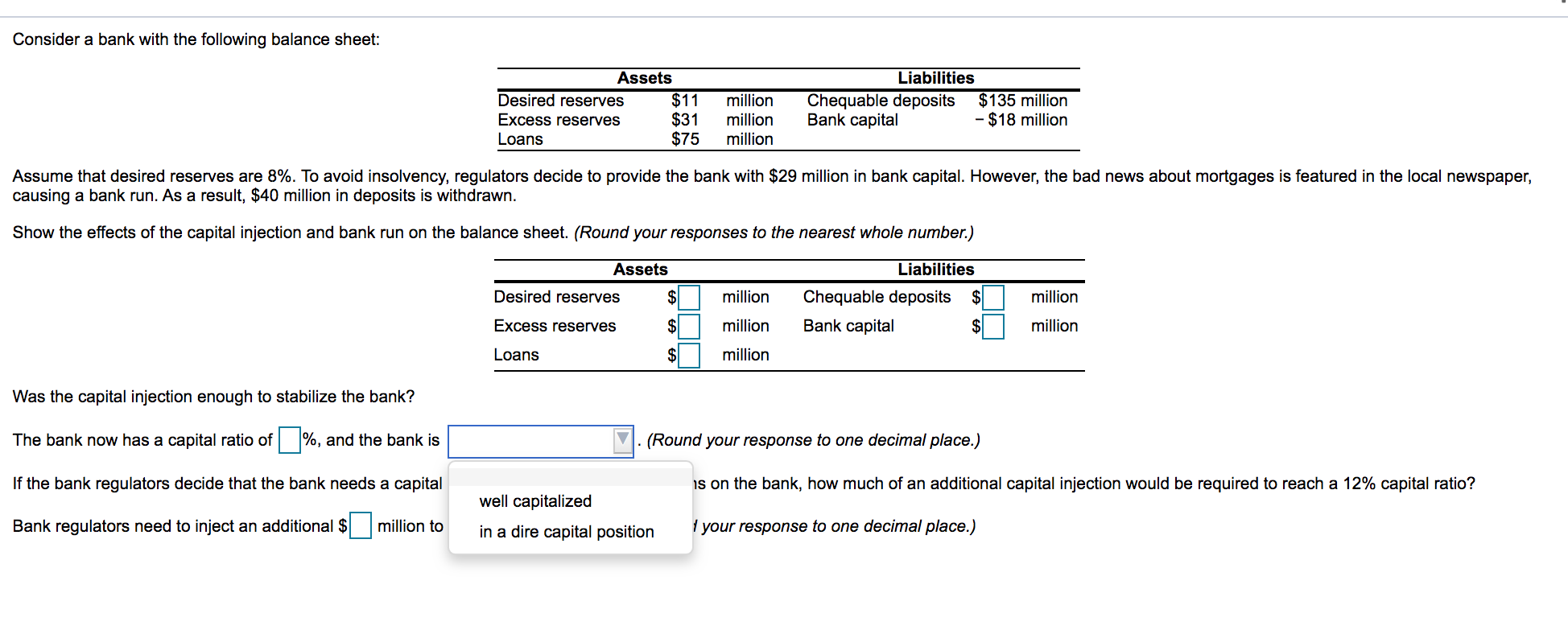

Question: Consider a bank with the following balance sheet: Assets Desired reserves $11 Excess reserves $31 Loans $75 million million million Liabilities Chequable deposits $135 million

Consider a bank with the following balance sheet: Assets Desired reserves $11 Excess reserves $31 Loans $75 million million million Liabilities Chequable deposits $135 million Bank capital - $18 million Assume that desired reserves are 8%. To avoid insolvency, regulators decide to provide the bank with $29 million in bank capital. However, the bad news about mortgages is featured in the local newspaper, causing a bank run. As a result, $40 million in deposits is withdrawn. Show the effects of the capital injection and bank run on the balance sheet. (Round your responses to the nearest whole number.) Assets Liabilities Desired reserves $ million $ million Chequable deposits Bank capital Excess reserves $ million $ million Loans $ million Was the capital injection enough to stabilize the bank? The bank now has a capital ratio of %, and the bank is (Round your response to one decimal place.) If the bank regulators decide that the bank needs a capital is on the bank, how much of an additional capital injection would be required to reach a 12% capital ratio? Bank regulators need to inject an additional $ well capitalized in a dire capital position million to your response to one decimal place.) Consider a bank with the following balance sheet: Assets Desired reserves $11 Excess reserves $31 Loans $75 million million million Liabilities Chequable deposits $135 million Bank capital - $18 million Assume that desired reserves are 8%. To avoid insolvency, regulators decide to provide the bank with $29 million in bank capital. However, the bad news about mortgages is featured in the local newspaper, causing a bank run. As a result, $40 million in deposits is withdrawn. Show the effects of the capital injection and bank run on the balance sheet. (Round your responses to the nearest whole number.) Assets Liabilities Desired reserves $ million $ million Chequable deposits Bank capital Excess reserves $ million $ million Loans $ million Was the capital injection enough to stabilize the bank? The bank now has a capital ratio of %, and the bank is (Round your response to one decimal place.) If the bank regulators decide that the bank needs a capital is on the bank, how much of an additional capital injection would be required to reach a 12% capital ratio? Bank regulators need to inject an additional $ well capitalized in a dire capital position million to your response to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts