Question: Consider a binomial tree problem for an American option. On December 8th, 2022, the stock price of APPLE was $142.65. Use one year of historical

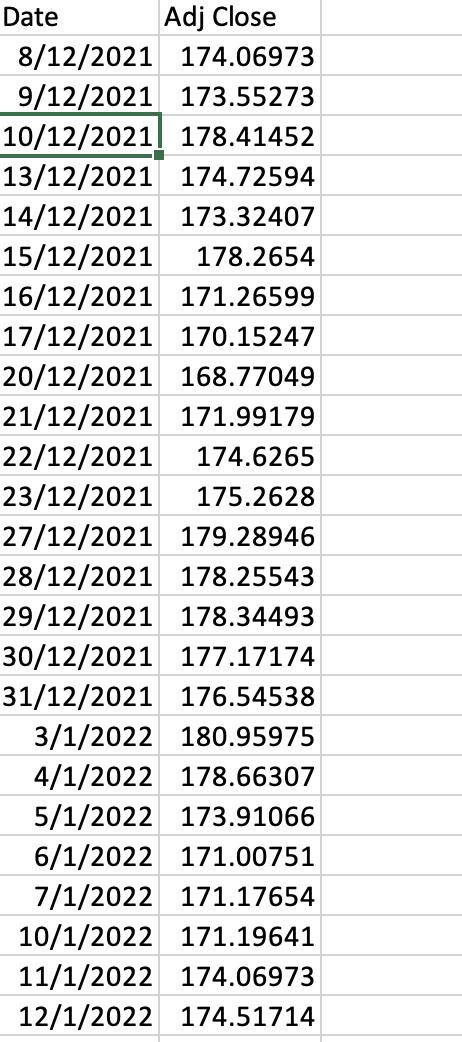

Consider a binomial tree problem for an American option. On December 8th, 2022, the stock price of APPLE was $142.65. Use one year of historical data to estimate appropriate values for u and d for the use in a two-step binomial option pricing model; the length of one time step is 1 day. The historical stock prices are given in the ‘data.xlsx’ file. (Tips: u=e^(σ√∆t);d=1/u. The volatility (σ) is calculated as the standard deviation of past daily returns*sqrt(252), assuming a year with 252 trading days.) Estimate the price of an American call option on APPLE stock with a strike price of $134 and a maturity of December 12th, 2022 (the duration is two trading days). Assume that the continuously risk-free rate is 1.76% per annum.

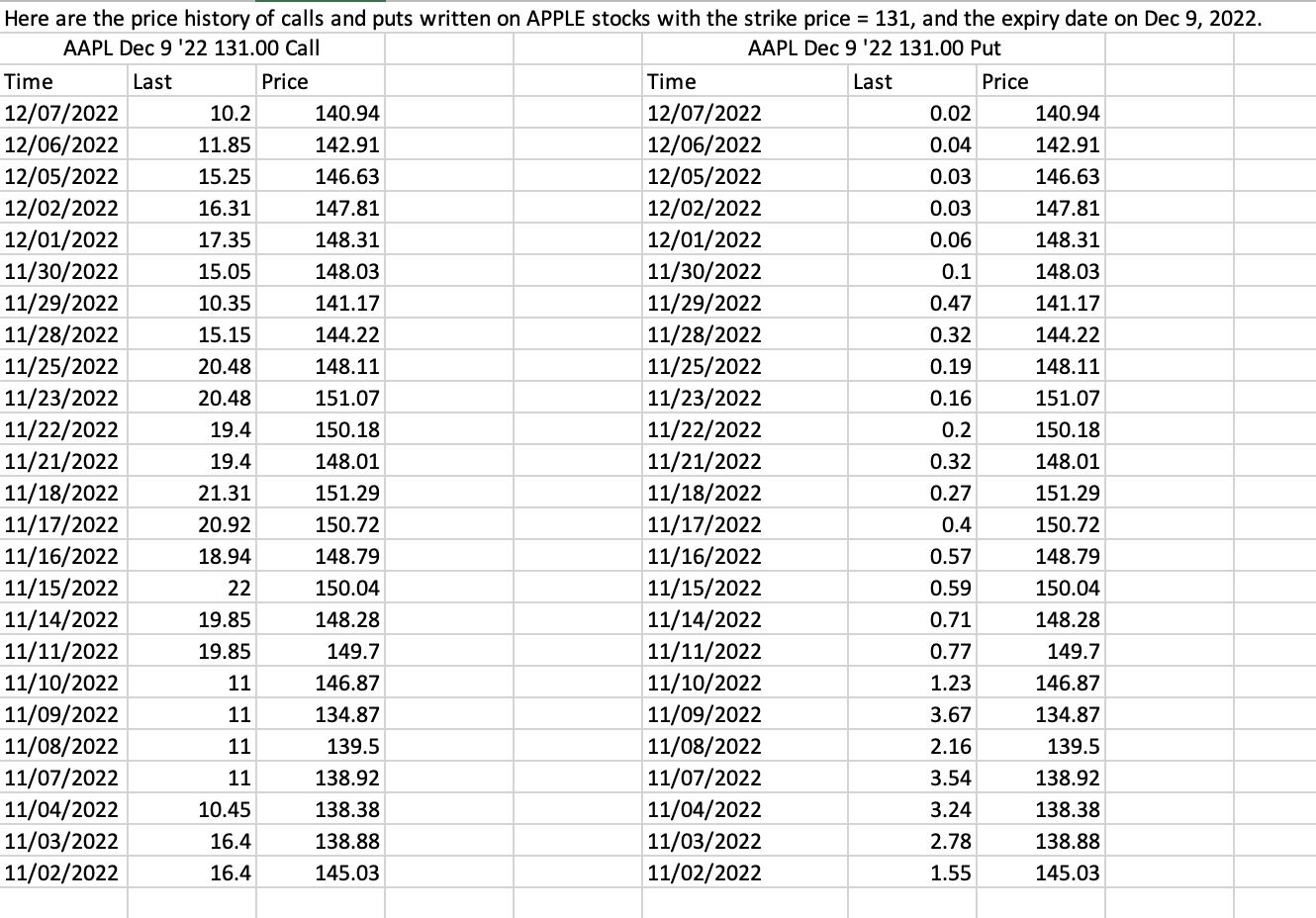

Here are the price history of calls and puts written on APPLE stocks with the strike price = 131, and the expiry date on Dec 9, 2022. AAPL Dec 9 '22 131.00 Call AAPL Dec 9 '22 131.00 Put Last Price Last Time 12/07/2022 12/06/2022 12/05/2022 12/02/2022 12/01/2022 11/30/2022 11/29/2022 11/28/2022 11/25/2022 11/23/2022 11/22/2022 11/21/2022 11/18/2022 11/17/2022 11/16/2022 11/15/2022 11/14/2022 11/11/2022 11/10/2022 11/09/2022 11/08/2022 11/07/2022 11/04/2022 11/03/2022 11/02/2022 10.2 11.85 15.25 16.31 17.35 15.05 10.35 15.15 20.48 20.48 19.4 19.4 21.31 20.92 18.94 22 19.85 19.85 11 11 11 11 10.45 16.4 16.4 140.94 142.91 146.63 147.81 148.31 148.03 141.17 144.22 148.11 151.07 150.18 148.01 151.29 150.72 148.79 150.04 148.28 149.7 146.87 134.87 139.5 138.92 138.38 138.88 145.03 Time 12/07/2022 12/06/2022 12/05/2022 12/02/2022 12/01/2022 11/30/2022 11/29/2022 11/28/2022 11/25/2022 11/23/2022 11/22/2022 11/21/2022 11/18/2022 11/17/2022 11/16/2022 11/15/2022 11/14/2022 11/11/2022 11/10/2022 11/09/2022 11/08/2022 11/07/2022 11/04/2022 11/03/2022 11/02/2022 0.02 0.04 0.03 0.03 0.06 0.1 0.47 0.32 0.19 0.16 0.2 0.32 0.27 0.4 0.57 0.59 0.71 0.77 1.23 3.67 2.16 3.54 3.24 2.78 1.55 Price 140.94 142.91 146.63 147.81 148.31 148.03 141.17 144.22 148.11 151.07 150.18 148.01 151.29 150.72 148.79 150.04 148.28 149.7 146.87 134.87 139.5 138.92 138.38 138.88 145.03

Step by Step Solution

There are 3 Steps involved in it

To estimate the price of an American call option using a twostep binomial option pricing model we first need to calculate the parameters u up factor a... View full answer

Get step-by-step solutions from verified subject matter experts