Question: Consider a Black-Scholes framework, where a market-maker sells a 1- year European gap call options on an underlying, non-dividend paying stock S. Each gap call

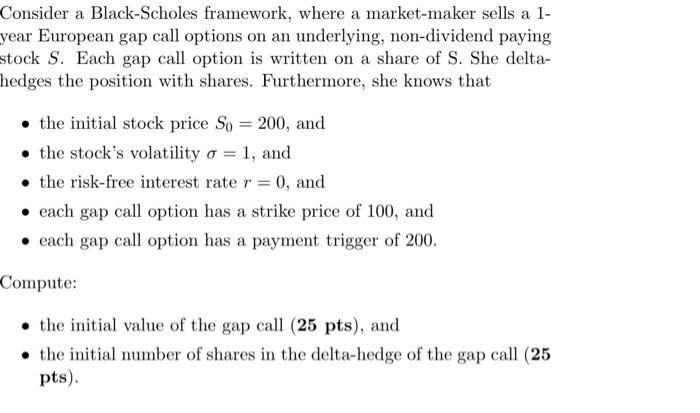

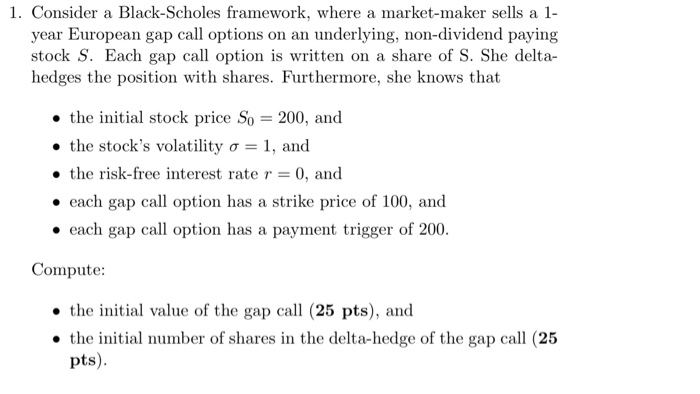

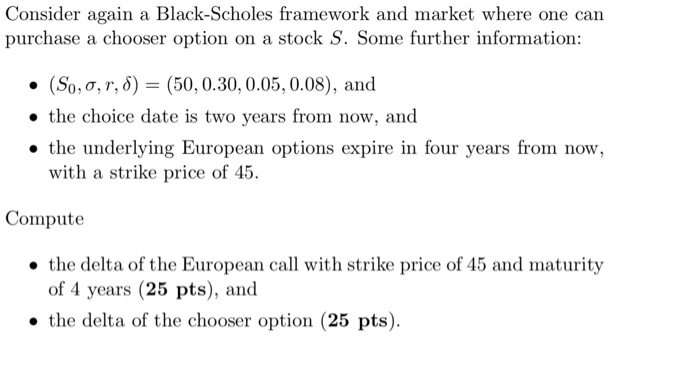

Consider a Black-Scholes framework, where a market-maker sells a 1- year European gap call options on an underlying, non-dividend paying stock S. Each gap call option is written on a share of S. She delta- hedges the position with shares. Furthermore, she knows that the initial stock price So = 200, and the stocks volatility o = 1, and the risk-free interest rate r = 0, and each gap call option has a strike price of 100, and each gap call option has a payment trigger of 200. Compute: the initial value of the gap call (25 pts), and the initial number of shares in the delta-hedge of the gap call (25 pts). 1. Consider a Black-Scholes framework, where a market-maker sells a l- year European gap call options on an underlying, non-dividend paying stock S. Each gap call option is written on a share of S. She delta- hedges the position with shares. Furthermore, she knows that the initial stock price So = 200, and the stock's volatility o = 1, and the risk-free interest rate r = 0, and each gap call option has a strike price of 100, and each gap call option has a payment trigger of 200. Compute: the initial value of the gap call (25 pts), and the initial number of shares in the delta-hedge of the gap call (25 pts). Consider again a Black-Scholes framework and market where one can purchase a chooser option on a stock S. Some further information: (S0,0,r, 8) = (50, 0.30, 0.05, 0.08), and the choice date is two years from now, and the underlying European options expire in four years from now, with a strike price of 45. Compute the delta of the European call with strike price of 45 and maturity of 4 years (25 pts), and the delta of the chooser option (25 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts