Question: Consider a bond issued on July 1st, 2021, whose face value is $1000 and priced at $1003.91 at issuance [FYI, in Bloomberg, this will

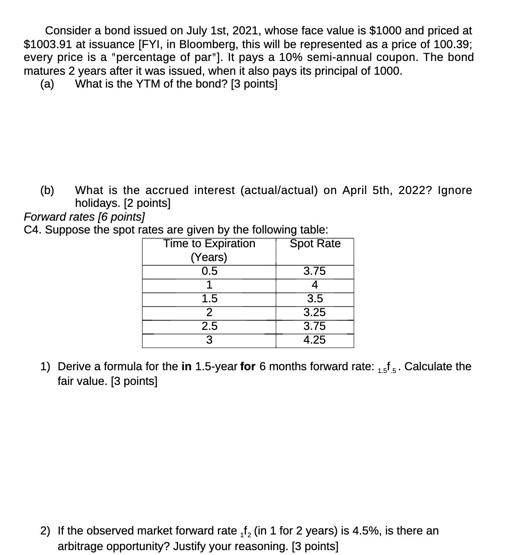

Consider a bond issued on July 1st, 2021, whose face value is $1000 and priced at $1003.91 at issuance [FYI, in Bloomberg, this will be represented as a price of 100.39; every price is a "percentage of par"]. It pays a 10% semi-annual coupon. The bond matures 2 years after it was issued, when it also pays its principal of 1000. (a) What is the YTM of the bond? [3 points] (b) Forward rates [6 points] C4. Suppose the spot rates are given by the following table: Time to Expiration Spot Rate What is the accrued interest (actual/actual) on April 5th, 2022? Ignore holidays. [2 points] (Years) 0.5 1 1.5 2 2.5 3 3.75 4 3.5 3.25 3.75 4.25 1) Derive a formula for the in 1.5-year for 6 months forward rate: 15f5. Calculate the fair value. [3 points] 2) If the observed market forward rate ,f, (in 1 for 2 years) is 4.5%, is there an arbitrage opportunity? Justify your reasoning. [3 points]

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Bond Analysis a Yield to Maturity YTM We can use a financial calculator or spreadsheet software with a builtin YTM function to find the YTM Inputs Fac... View full answer

Get step-by-step solutions from verified subject matter experts