Question: Consider a bond with a 7.1% coupon and a yield to maturity of 3.6% maturing in just over 21 years. Suppose the bond was purchased

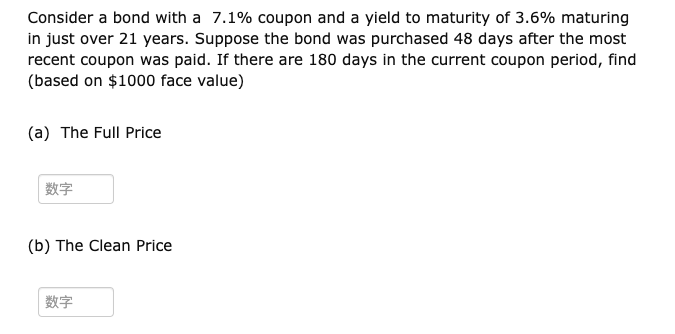

Consider a bond with a 7.1% coupon and a yield to maturity of 3.6% maturing in just over 21 years. Suppose the bond was purchased 48 days after the most recent coupon was paid. If there are 180 days in the current coupon period, find (based on $1000 face value) (a) The Full Price (b) The Clean Price #

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock