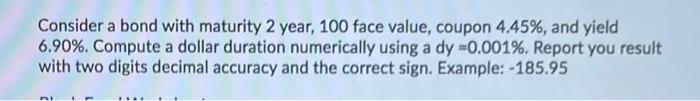

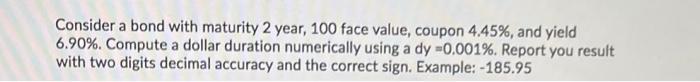

Question: Consider a bond with maturity 2 year, 100 face value, coupon 4.45%, and yield 6.90%. Compute a dollar duration numerically using a dy =0.001%. Report

Consider a bond with maturity 2 year, 100 face value, coupon 4.45%, and yield 6.90%. Compute a dollar duration numerically using a dy =0.001%. Report you result with two digits decimal accuracy and the correct sign. Example: -185.95 State the put-call parity for European options, explain how to proof the ind explain under what conditions it may not hold. shia Consider a bond with maturity 2 year, 100 face value, coupon 4.45%, and yield 6.90%. Compute a dollar duration numerically using a dy =0,001%. Report you result with two digits decimal accuracy and the correct sign. Example: -185.95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts