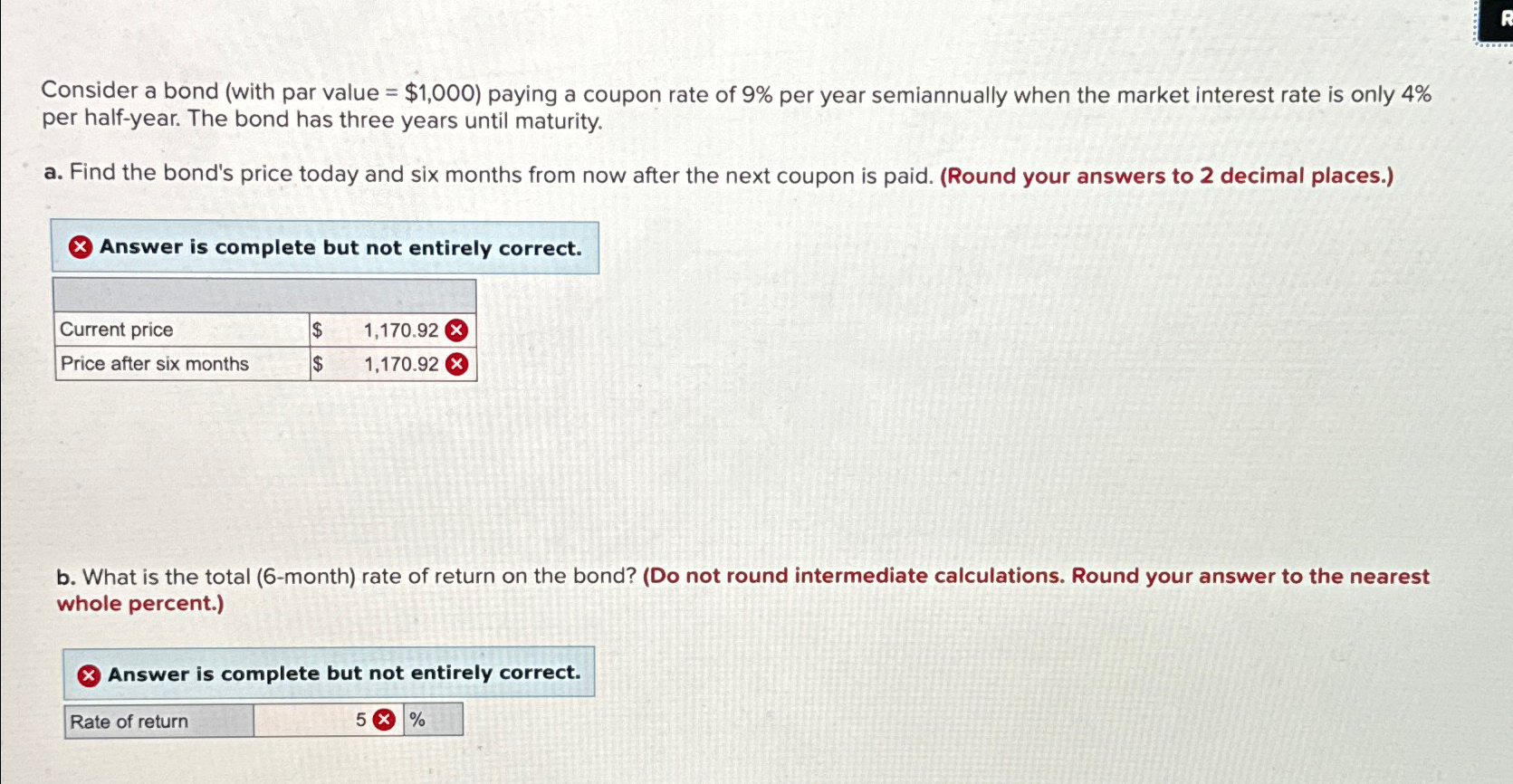

Question: Consider a bond ( with par value = $ 1 , 0 0 0 ) paying a coupon rate of 9 % per year semiannually

Consider a bond with par value $ paying a coupon rate of per year semiannually when the market interest rate is only per halfyear. The bond has three years until maturity.

a Find the bond's price today and six months from now after the next coupon is paid. Round your answers to decimal places.

Answer is complete but not entirely correct.

tableCurrent price,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock