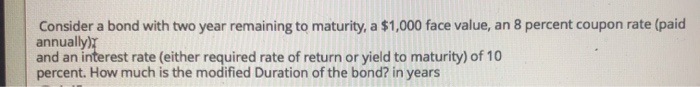

Question: Consider a bond with two year remaining to maturity, a $1,000 face value, an 8 percent coupon rate (paid annually) and an interest rate (either

Consider a bond with two year remaining to maturity, a $1,000 face value, an 8 percent coupon rate (paid annually) and an interest rate (either required rate of return or yield to maturity) of 10 percent. How much is the modified Duration of the bond? in years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts