Question: Consider a call option on NetActive with an exercise price of $75. You calculate that N(da) = 0.1916 and N(dz) = 0.1273. Based on this

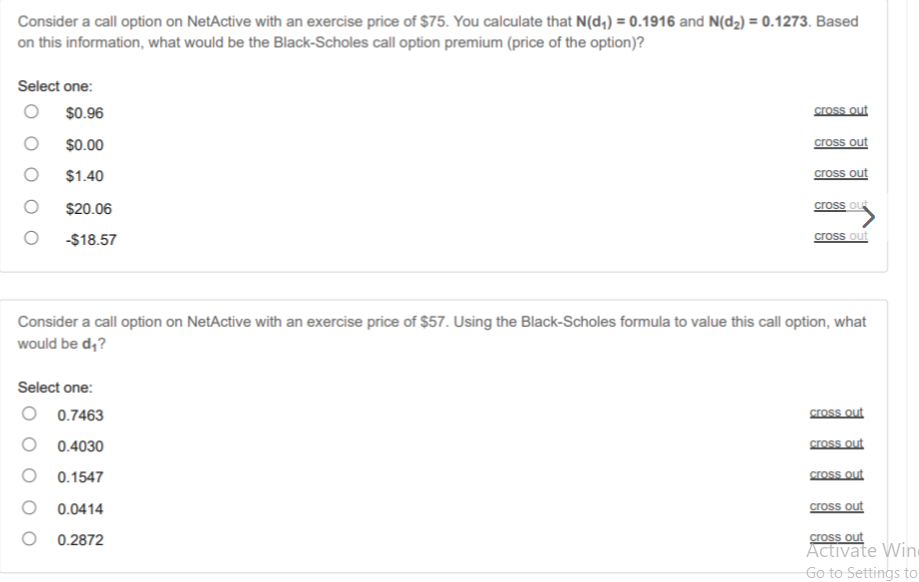

Consider a call option on NetActive with an exercise price of $75. You calculate that N(da) = 0.1916 and N(dz) = 0.1273. Based on this information, what would be the Black-Scholes call option premium (price of the option)? Select one: O $0.96 O $0.00 cross out cross out O $1.40 cross out O $20.06 cross ou $18.57 cross out Consider a call option on NetActive with an exercise price of $57. Using the Black-Scholes formula to value this call option, what would be d? Select one: o 0.7463 cross out O 0.4030 cross out 0.1547 cross out O 0.0414 cross out O 0.2872 cross out Activate Win Go to Settings to Consider a call option on NetActive with an exercise price of $75. You calculate that N(da) = 0.1916 and N(dz) = 0.1273. Based on this information, what would be the Black-Scholes call option premium (price of the option)? Select one: O $0.96 O $0.00 cross out cross out O $1.40 cross out O $20.06 cross ou $18.57 cross out Consider a call option on NetActive with an exercise price of $57. Using the Black-Scholes formula to value this call option, what would be d? Select one: o 0.7463 cross out O 0.4030 cross out 0.1547 cross out O 0.0414 cross out O 0.2872 cross out Activate Win Go to Settings to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts