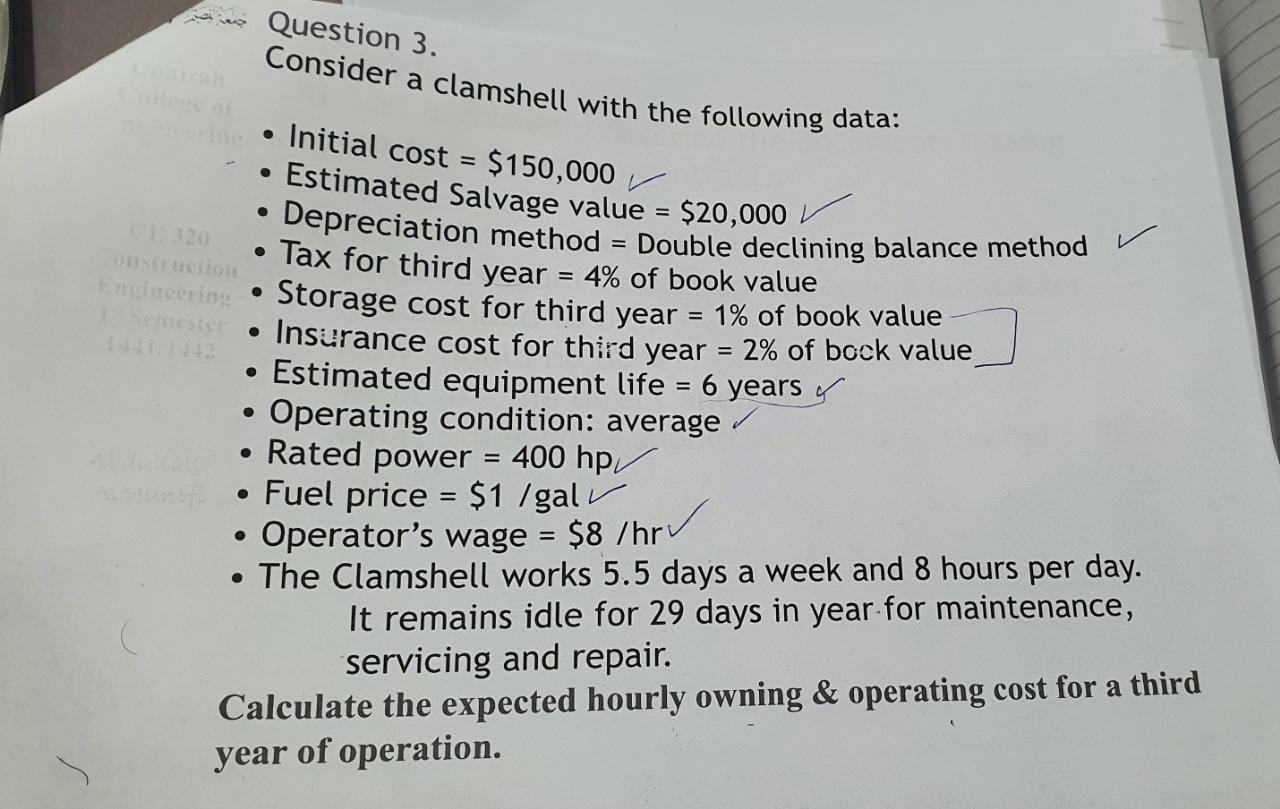

Question: Consider a clamshell with the following data: Question 3. Initial cost = $150,000 V Estimated Salvage value = $20,000 Depreciation method Tax for third year

Consider a clamshell with the following data: Question 3. Initial cost = $150,000 V Estimated Salvage value = $20,000 Depreciation method Tax for third year = 4% of book value O 320 Ostruction Engineering este . Double declining balance method Storage cost for third year = 1% of book value Insurance cost for third year = 2% of bock value Estimated equipment life = 6 years y Operating condition: average Rated power = 400 hp/ Fuel price = $1 /gal v Operator's wage = $8 /hrv The Clamshell works 5.5 days a week and 8 hours per day. It remains idle for 29 days in year for maintenance, servicing and repair. Calculate the expected hourly owning & operating cost for a third year of operation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts