Question: Consider a commercial project with the following characteristics: 1. Initial cash outlay of Kshs 80,000,000. 2. The project is expected to have a useful

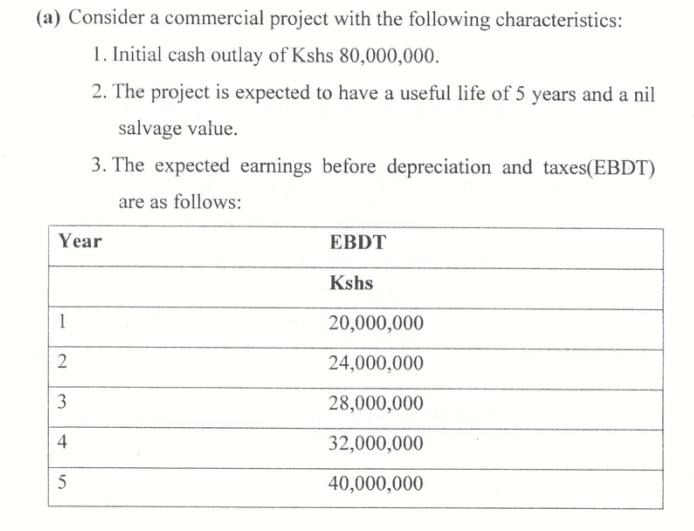

Consider a commercial project with the following characteristics: 1. Initial cash outlay of Kshs 80,000,000. 2. The project is expected to have a useful life of 5 years and a nil salvage value. 3. The expected earnings before depreciation and taxes(EBDT) are as follows: Year 1 2 3 4 5 EBDT Kshs 20,000,000 24,000,000 28,000,000 32,000,000 40,000,000 The cost of capital applicable to this project is 12 %. Required: Appraise the project's financial feasibility using: (i) Return on investment (ii) Net Present Value (4 marks) (6 marks)

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below i Return on Investment RO... View full answer

Get step-by-step solutions from verified subject matter experts