Question: Consider a consumer who chooses consumption levels in two consecutive time periods to maximize utility. The consumer's utility function is ?(?_1, ?_2 ) = (?_1)(?_2),

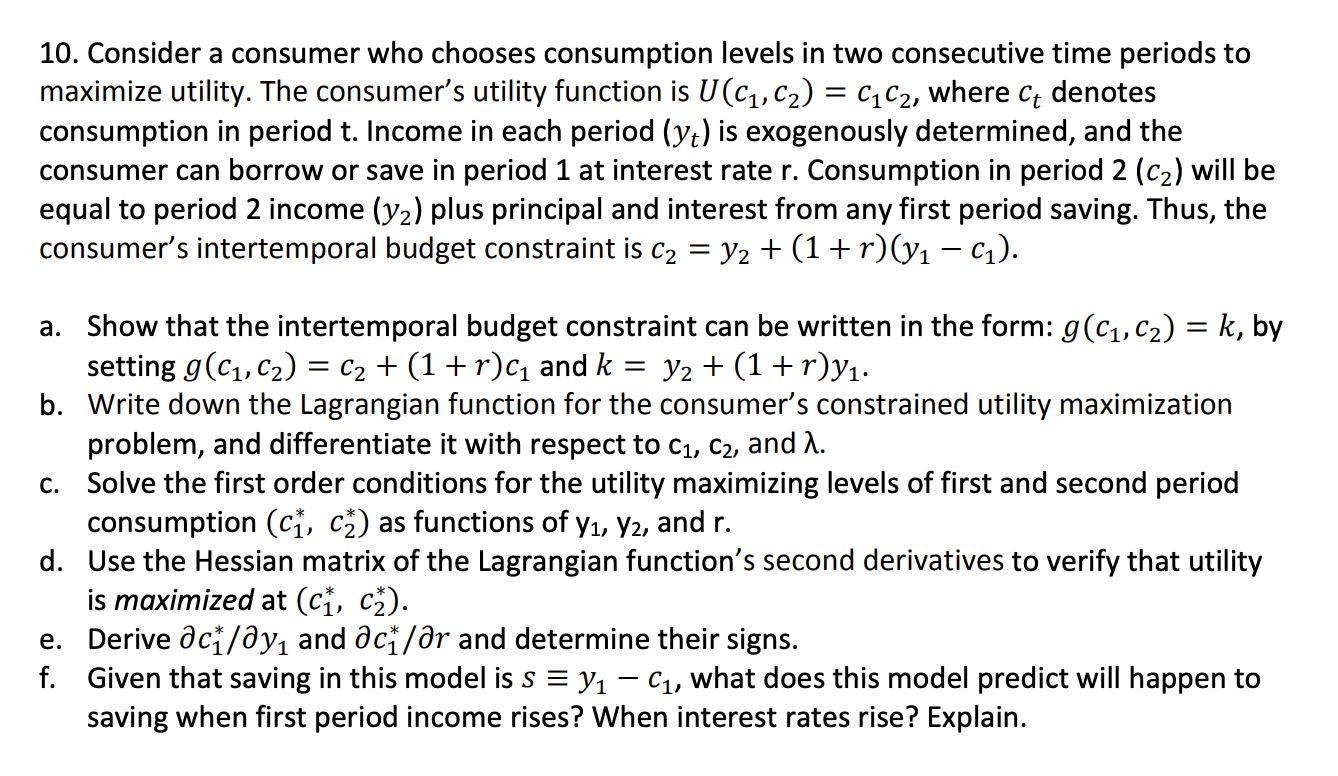

Consider a consumer who chooses consumption levels in two consecutive time periods to maximize utility. The consumer's utility function is ?(?_1, ?_2 ) = (?_1)(?_2), where ?_? denotes consumption in period t. Income in each period (?_? ) is exogenously determined, and the consumer can borrow or save in period 1 at interest rate r. Consumption in period 2 (?_2) will be equal to period 2 income (?_2) plus principal and interest from any first period saving. Thus, the consumer's intertemporal budget constraint is ?_2 = ?_2 + (1 + ?)(?_1 ? ?_1 ).

a. Show that the intertemporal budget constraint can be written in the form: ?(?_1, ?_2) = ?, by setting ?(?_1, ?_2 ) = ?_2 + (1 + ?)?_1 and ? = ?_2 + (1 + ?)?_1.

b. Write down the Lagrangian function for the consumer's constrained utility maximization problem, and differentiate it with respect to c_1, c_2, and ?.

c. Solve the first order conditions for the utility maximizing levels of first and second period consumption (?_1* , ?_2*) as functions of y_1, y_2, and r.

d. Use the Hessian matrix of the Lagrangian function's second derivatives to verify that utility is maximized at (?_1* , ?_2* ).

e. Derive ??_1*/??1 and ??_1*/?? and determine their signs.

f. Given that saving in this model is ? ? ?_1 ? ?_

10. Consider a consumer who chooses consumption levels in two consecutive time periods to maximize utility. The consumer's utility function is U(c1, C2) = 6162, where ct denotes consumption in period t. Income in each period (31,) is exogenously determined, and the consumer can borrow or save in period 1 at interest rate r. Consumption in period 2 (c2) will be equal to period 2 income (yz) plus principal and interest from any first period saving. Thus, the consumer's intertemporal budget constraint is (:2 = 312 + (1 + r)(y1 (:1). a. Show that the intertemporal budget constraint can be written in the form: g(c1, (:2) = k, by setting g(c1, c2) = 2 + (1 + r)c1 and k = y2 + (1 + r)y1. b. Write down the Lagrangian function for the consumer's constrained utility maximization problem, and differentiate it with respect to c1, c2, and A. c. Solve the first order conditions for the utility maximizing levels of first and second period consumption (CI, C3) as functions of y1, y;, and r. d. Use the Hessian matrix of the Lagrangian function's second derivatives to verify that utility is maximized at (cf, c3). e. Derive def/6311 and def/6r and determine their signs. Given that saving in this model is s E y1 cl, what does this model predict will happen to saving when first period income rises? When interest rates rise? Explain. Th

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts