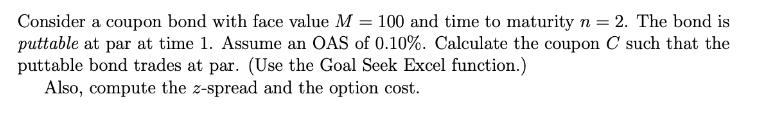

Question: Consider a coupon bond with face value M = 100 and time to maturity n = 2. The bond is puttable at par at

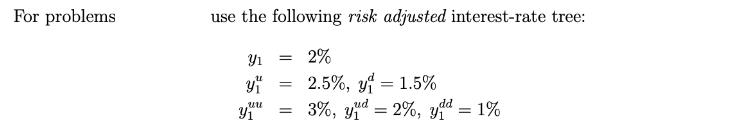

Consider a coupon bond with face value M = 100 and time to maturity n = 2. The bond is puttable at par at time 1. Assume an OAS of 0.10%. Calculate the coupon C such that the puttable bond trades at par. (Use the Goal Seek Excel function.) Also, compute the z-spread and the option cost. For problems use the following risk adjusted interest-rate tree: = 2% Y 41 uu y = = 2.5%, y = 1.5% dd 3%, yud - 2%, ydd = 1% =

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Here are the steps to solve this problem in Excel using Goal Seek 1 Set up the ... View full answer

Get step-by-step solutions from verified subject matter experts