Question: Consider a decision maker who is an expected utility maximizer. Her preferences over wealth levels are represented by the Bernoulli utility function u(). The decision

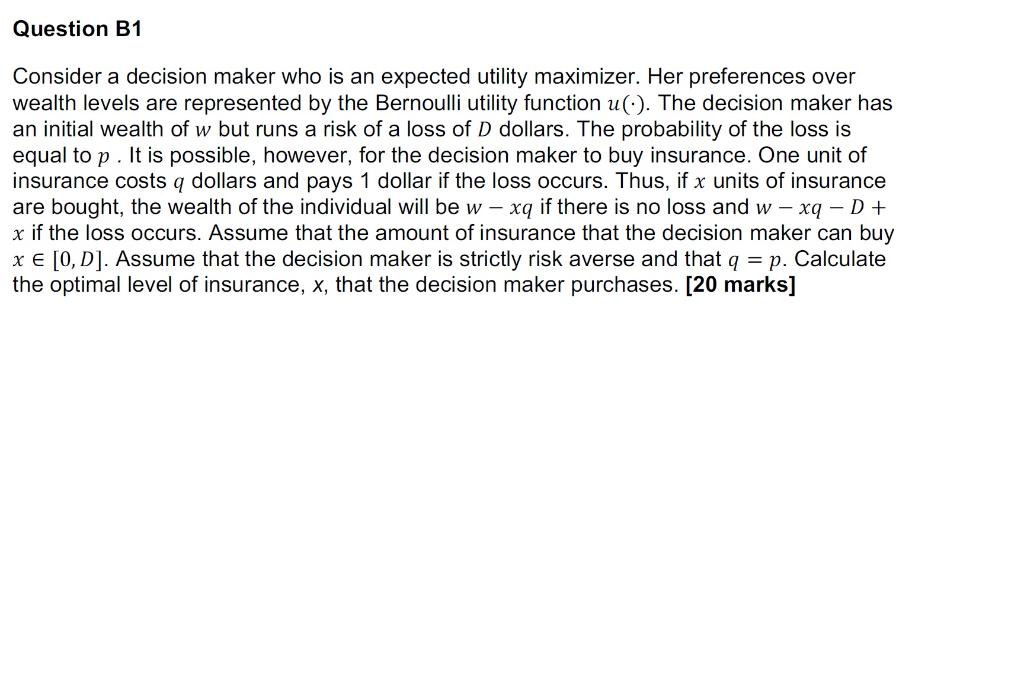

Consider a decision maker who is an expected utility maximizer. Her preferences over wealth levels are represented by the Bernoulli utility function u(). The decision maker has an initial wealth of w but runs a risk of a loss of D dollars. The probability of the loss is equal to p. It is possible, however, for the decision maker to buy insurance. One unit of insurance costs q dollars and pays 1 dollar if the loss occurs. Thus, if x units of insurance are bought, the wealth of the individual will be wxq if there is no loss and wxqD+ x if the loss occurs. Assume that the amount of insurance that the decision maker can buy x[0,D]. Assume that the decision maker is strictly risk averse and that q=p. Calculate the optimal level of insurance, x, that the decision maker purchases. [20 marks] Consider a decision maker who is an expected utility maximizer. Her preferences over wealth levels are represented by the Bernoulli utility function u(). The decision maker has an initial wealth of w but runs a risk of a loss of D dollars. The probability of the loss is equal to p. It is possible, however, for the decision maker to buy insurance. One unit of insurance costs q dollars and pays 1 dollar if the loss occurs. Thus, if x units of insurance are bought, the wealth of the individual will be wxq if there is no loss and wxqD+ x if the loss occurs. Assume that the amount of insurance that the decision maker can buy x[0,D]. Assume that the decision maker is strictly risk averse and that q=p. Calculate the optimal level of insurance, x, that the decision maker purchases. [20 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts