Question: Consider a dispute between a labor union (player 1) and a firm (player 2). Suppose that there is some quantity to be distributed to

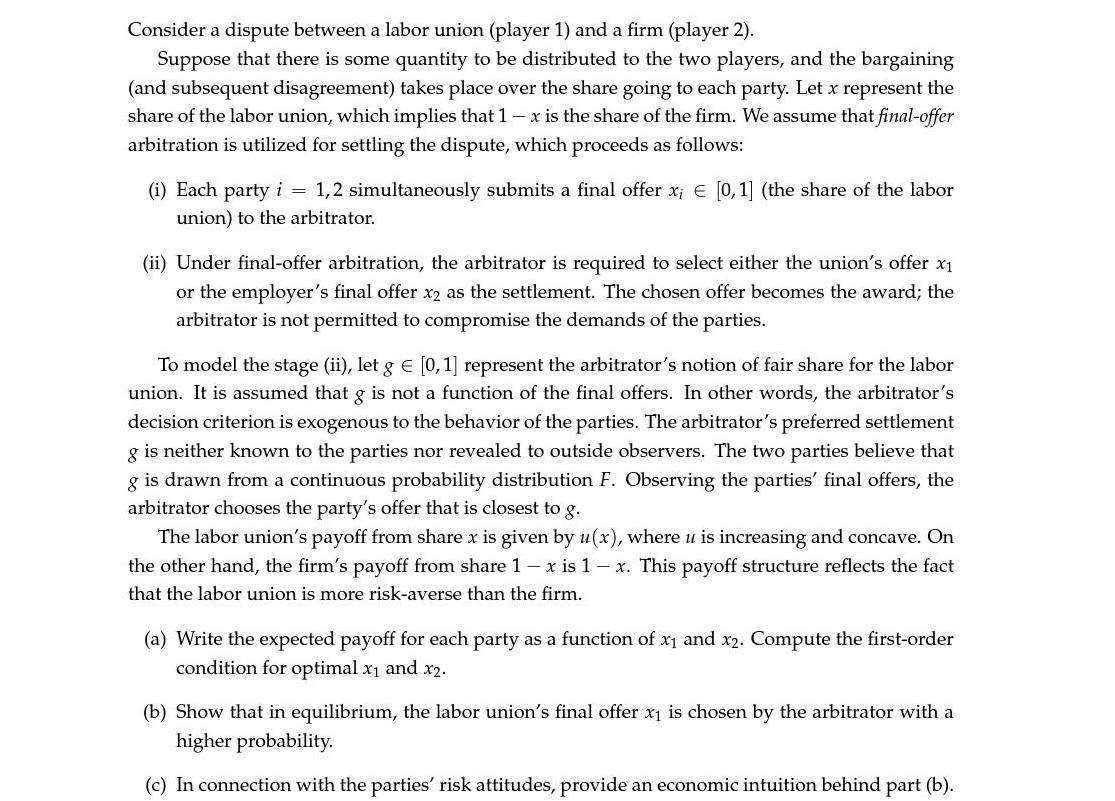

Consider a dispute between a labor union (player 1) and a firm (player 2). Suppose that there is some quantity to be distributed to the two players, and the bargaining (and subsequent disagreement) takes place over the share going to each party. Let x represent the share of the labor union, which implies that 1 - x is the share of the firm. We assume that final-offer arbitration is utilized for settling the dispute, which proceeds as follows: (i) Each party i = 1,2 simultaneously submits a final offer x; [0,1] (the share of the labor union) to the arbitrator. (ii) Under final-offer arbitration, the arbitrator is required to select either the union's offer x or the employer's final offer x2 as the settlement. The chosen offer becomes the award; the arbitrator is not permitted to compromise the demands of the parties. To model the stage (ii), let g = [0, 1] represent the arbitrator's notion of fair share for the labor union. It is assumed that g is not a function of the final offers. In other words, the arbitrator's decision criterion is exogenous to the behavior of the parties. The arbitrator's preferred settlement g is neither known to the parties nor revealed to outside observers. The two parties believe that g is drawn from a continuous probability distribution F. Observing the parties' final offers, the arbitrator chooses the party's offer that is closest to g. The labor union's payoff from share x is given by u(x), where u is increasing and concave. On the other hand, the firm's payoff from share 1 - x is 1-x. This payoff structure reflects the fact that the labor union is more risk-averse than the firm. (a) Write the expected payoff for each party as a function of x and x2. Compute the first-order condition for optimal x and x2. (b) Show that in equilibrium, the labor union's final offer x is chosen by the arbitrator with a higher probability. (c) In connection with the parties' risk attitudes, provide an economic intuition behind part (b).

Step by Step Solution

3.32 Rating (164 Votes )

There are 3 Steps involved in it

Consider a dispute between a labor union player 1 and a firm player 2 Suppose that there is some quantity to be distributed to the two players and the bargaining and subsequent disagreement takes plac... View full answer

Get step-by-step solutions from verified subject matter experts