Question: Consider a firm that operates for two periods using capital and labor to produce. The firm starts with K units capital and has to decide

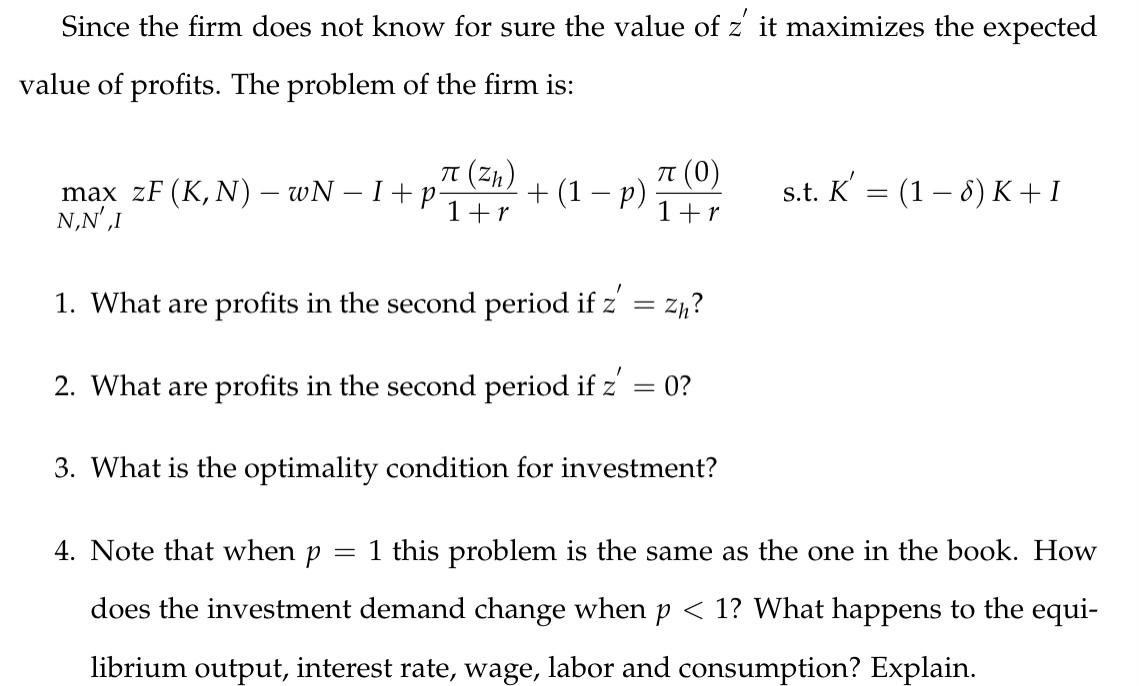

Consider a firm that operates for two periods using capital and labor to produce. The firm starts with K units capital and has to decide optimally its labor demand for both periods and the investment so as to maximize the discounted value of profits. When the firm chooses the investment it is uncertain about the value of future productivity. The firm thinks that with probability p the productivity is going to be high (zh ), and with probability 1-p it is going to be zero, so that no production takes place in the future (no labor is hired and no capital is used, so there is no depreciation). Note that it is only profitable to invest when z is higher than zero. Since the firm does not know for sure the value of z it maximizes the expected value of profits. The problem of the firm is:

Since the firm does not know for sure the value of z' it maximizes the expected value of profits. The problem of the firm is: a (zn) (0) max zF (K, N) WN I +p + (1 - p) 1+r 1+r N,N',I s.t. K' = (1 8) K+1 1. What are profits in the second period if z' = Zn? 2. What are profits in the second period if z' = 0? 3. What is the optimality condition for investment? 4. Note that when p = 1 this problem is the same as the one in the book. How does the investment demand change when p

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts