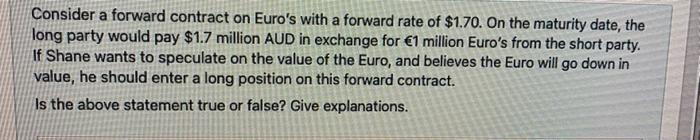

Question: Consider a forward contract on Euro's with a forward rate of $1.70. On the maturity date, the long party would pay $1.7 million AUD in

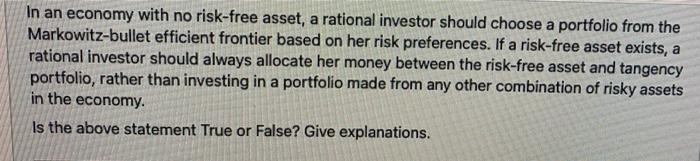

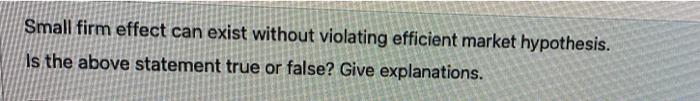

Consider a forward contract on Euro's with a forward rate of $1.70. On the maturity date, the long party would pay $1.7 million AUD in exchange for 1 million Euro's from the short party. If Shane wants to speculate on the value of the Euro, and believes the Euro will go down in value, he should enter a long position on this forward contract. Is the above statement true or false? Give explanations. In an economy with no risk-free asset, a rational investor should choose a portfolio from the Markowitz-bullet efficient frontier based on her risk preferences. If a risk-free asset exists, a rational investor should always allocate her money between the risk-free asset and tangency portfolio, rather than investing in a portfolio made from any other combination of risky assets in the economy. Is the above statement True or False? Give explanations. Small firm effect can exist without violating efficient market hypothesis. Is the above statement true or false? Give explanations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts