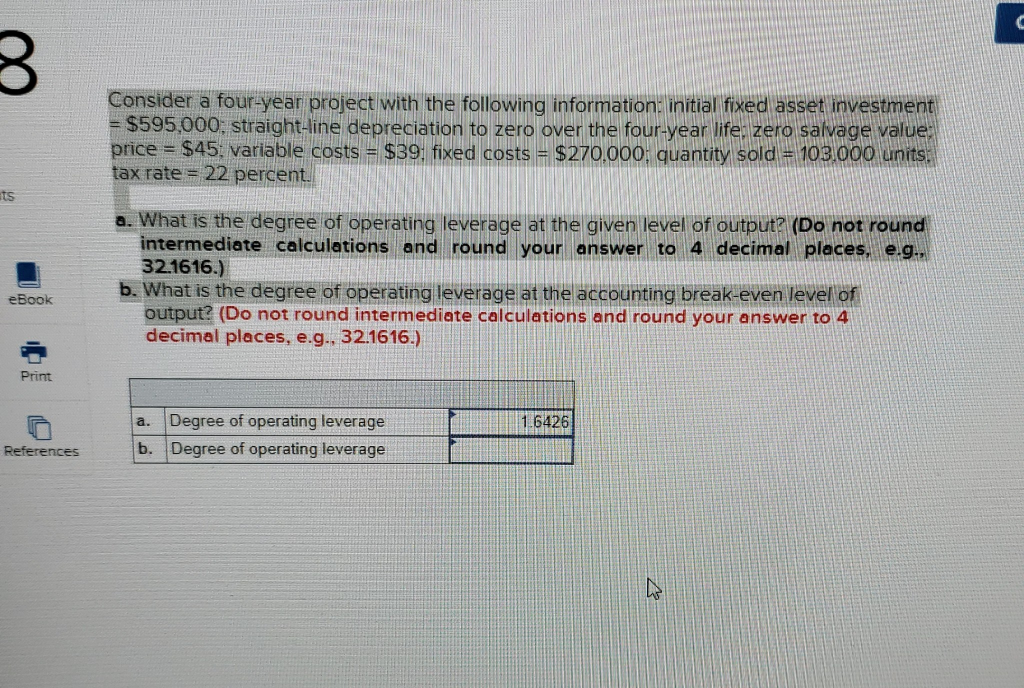

Question: Consider a four year project with the following information: Initial fixed asset investment -$595,000; straight-line depreciation to zero over the four-year life. zero salvage value

Consider a four year project with the following information: Initial fixed asset investment -$595,000; straight-line depreciation to zero over the four-year life. zero salvage value price -$45. variable costs- $39 fixed costs - $270.000: quantity sold #103000 units tax rate- 22 percent ts o. What is the degree of operating leverage at the given level of output? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g 32.1616.) b. What is the degree of operating leverage at the accounting Ibreak-even level of eBook output? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g. 321616.) Print a. Degree of operating leverage References b. Degree of operating leverage 1,6426

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts