Question: Consider a four-year project with the following information: initial fixed asset investment $480,000; straight-line depreciation to zero over the four-year life; zere salvage value;

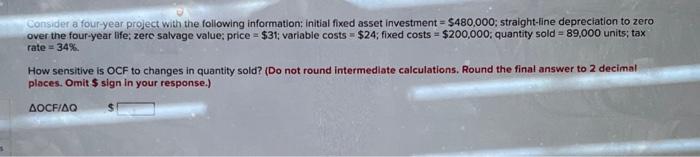

Consider a four-year project with the following information: initial fixed asset investment $480,000; straight-line depreciation to zero over the four-year life; zere salvage value; price $31; variable costs $24; fixed costs $200,000; quantity sold 89,000 units; tax rate=34% How sensitive is OCF to changes in quantity sold? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) AOCF/AQ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts