Question: Consider a four-year project with the following information: -Initial project: $480,000 -Straight-line deprectetion to zero over the four year life -Zero salvage value -Price per

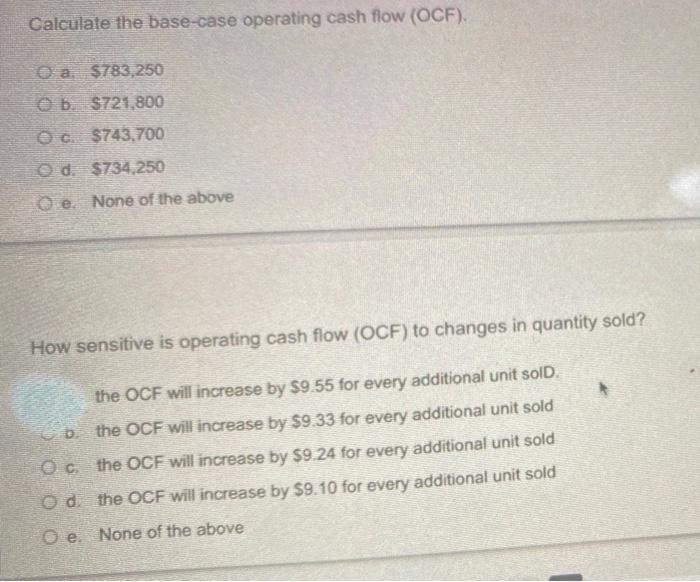

Calculate the base-case operating cash flow (OCF). 0 a $783,250 @b. $721,800 O0.5743,700 od 5734,250 De None of the above How sensitive is operating cash flow (OCF) to changes in quantity sold? the OCF will increase by 59.55 for every additional unit sold. the OCF will increase by 59.33 for every additional unit sold Oc the OCF will increase by 59.24 for every additional unit sold ed the OCF will increase by 59.10 for every additional unit sold e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts