Question: Consider a hedge fund that only runs for a year, and it has assets under management (AUM) of $1 billion. The manager is paid

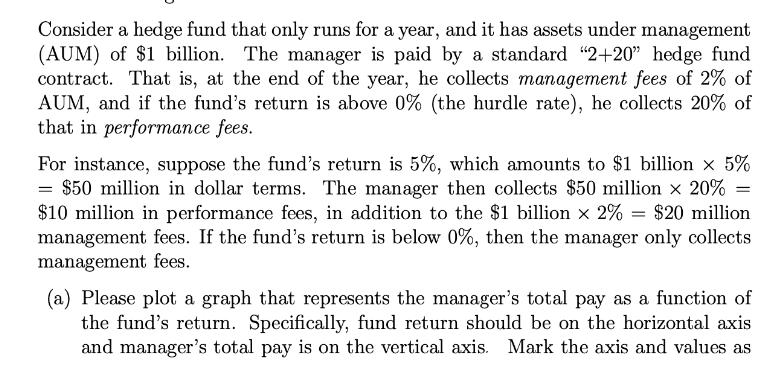

Consider a hedge fund that only runs for a year, and it has assets under management (AUM) of $1 billion. The manager is paid by a standard "2+20" hedge fund contract. That is, at the end of the year, he collects management fees of 2% of AUM, and if the fund's return is above 0% (the hurdle rate), he collects 20% of that in performance fees. For instance, suppose the fund's return is 5%, which amounts to $1 billion x 5% = $50 million in dollar terms. The manager then collects $50 million 20% $10 million in performance fees, in addition to the $1 billion x 2% = $20 million management fees. If the fund's return is below 0%, then the manager only collects management fees. (a) Please plot a graph that represents the manager's total pay as a function of the fund's return. Specifically, fund return should be on the horizontal axis and manager's total pay is on the vertical axis. Mark the axis and values as

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

a Please see the graph below b For strategy 1 sure 5 return Return is 5 50 million Management fees 2 ... View full answer

Get step-by-step solutions from verified subject matter experts