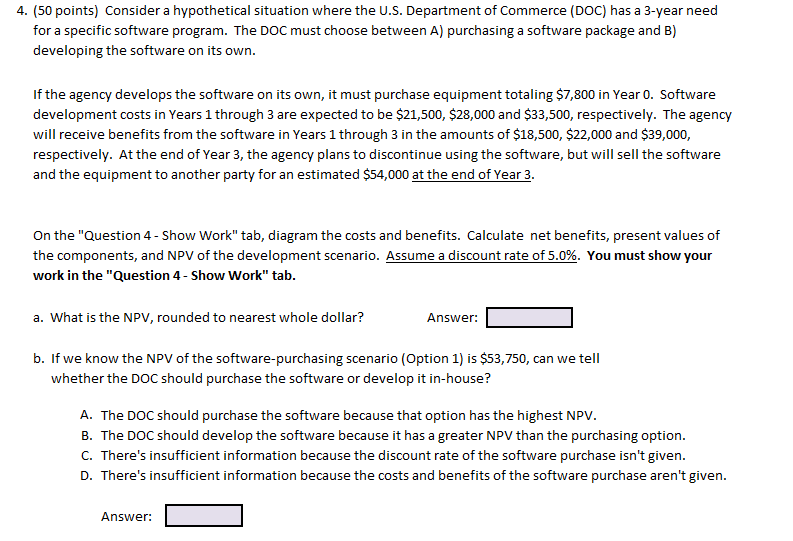

Question: Consider a hypothetical situation where the U . S . Department of Commerce ( DOC ) has a 3 - year need for a specific

Consider a hypothetical situation where the US Department of Commerce DOC has a year need

for a specific software program. The DOC must choose between A purchasing a software package and B

developing the software on its own.

If the agency develops the software on its own, it must purchase equipment totaling $ in Year Software

development costs in Years through are expected to be $$ and $ respectively. The agency

will receive benefits from the software in Years through in the amounts of $$ and $

respectively. At the end of Year the agency plans to discontinue using the software, but will sell the software

and the equipment to another party for an estimated $ at the end of Year

On the "Question Show Work" tab, diagram the costs and benefits. Calculate net benefits, present values of

the components, and NPV of the development scenario. Assume a discount rate of You must show your

work in the "Question Show Work excel tab.

I have the NPV and PV formulas, but not sure how to apply the rule of to assist with answering

a What is the NPV rounded to nearest whole dollar?

Answer:

b If we know the NPV of the softwarepurchasing scenario Option is $ can we tell

whether the DOC should purchase the software or develop it inhouse?

A The DOC should purchase the software because that option has the highest NPV

B The DOC should develop the software because it has a greater NPV than the purchasing option.

C There's insufficient information because the discount rate of the software purchase isn't given.

D There's insufficient information because the costs and benefits of the software purchase aren't given.

Answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock