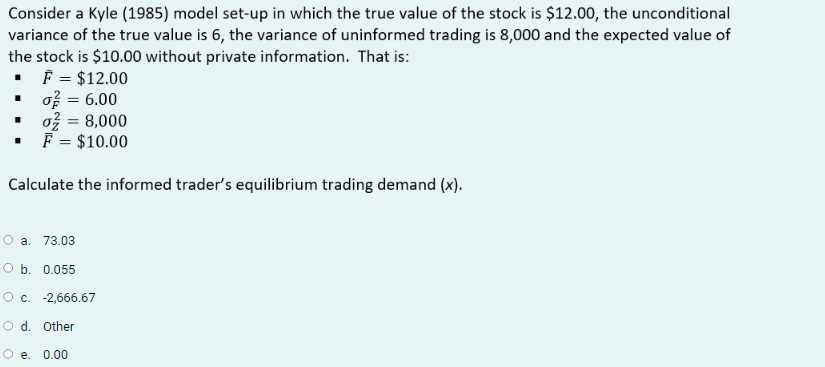

Question: Consider a Kyle (1985) model set-up in which the true value of the stock is $12.00, the unconditional variance of the true value is 6,

Consider a Kyle (1985) model set-up in which the true value of the stock is $12.00, the unconditional variance of the true value is 6, the variance of uninformed trading is 8,000 and the expected value of the stock is $10.00 without private information. That is: . F = $12.00 of = 6.00 o = 8,000 = $10.00 . Calculate the informed trader's equilibrium trading demand (x). O a. 73.03 O b. 0.055 O c. 2,666.67 O d. Other O e. 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts