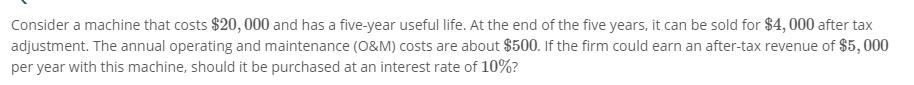

Question: Consider a machine that costs $20,000 and has a five-year useful life. At the end of the five years, it can be sold for

Consider a machine that costs $20,000 and has a five-year useful life. At the end of the five years, it can be sold for $4,000 after tax adjustment. The annual operating and maintenance (O&M) costs are about $500. If the firm could earn an after-tax revenue of $5,000 per year with this machine, should it be purchased at an interest rate of 10%?

Step by Step Solution

There are 3 Steps involved in it

SOLUTION Cost of machine 20000 Salvage value after tax 4000 O... View full answer

Get step-by-step solutions from verified subject matter experts