Question: Consider a market in which two agents, A and B, are making optimal investment decisions over one period (dates t=0 and 1). Their utility functions

Consider a market in which two agents, A and B, are making optimal investment decisions over one period (dates t=0 and 1). Their utility functions have a negative potential.

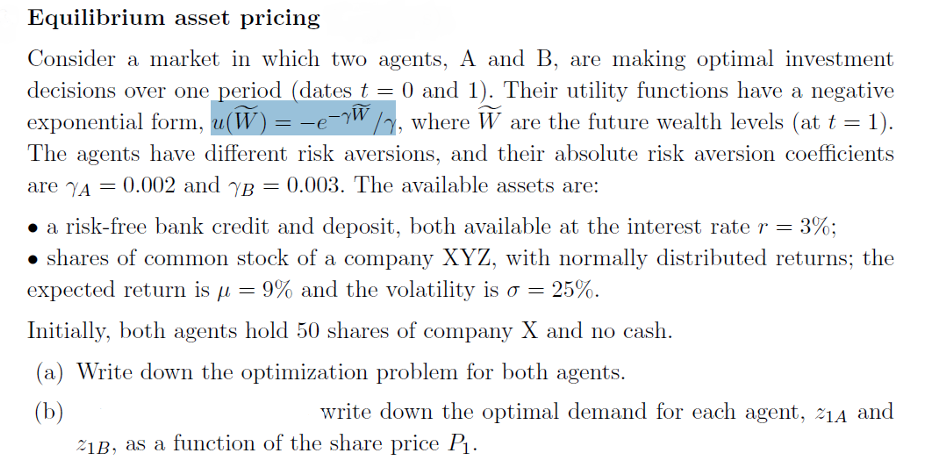

Equilibrium asset pricing decisions over one period (dates t0 and 1). Their utility functions have a negative exponential form, u(W)ewhere W are the future wealth levels (at t-1) The agents have different risk aversions, and their absolute risk aversion coefficients are 0.002 and = 0.003. The available assets are: . a risk-free bank credit and deposit, both available at the interest rate r-3%; shares of common stock of a company XYZ, with normally distributed returns; the expected return is = 9% and the volatility is = 25% Initially, both agents hold 50 shares of company X and no cash (a) Write down the optimization problem for both agents. write down the optimal demand for each agent, 21A and SIB, as a function of the share price P. Equilibrium asset pricing decisions over one period (dates t0 and 1). Their utility functions have a negative exponential form, u(W)ewhere W are the future wealth levels (at t-1) The agents have different risk aversions, and their absolute risk aversion coefficients are 0.002 and = 0.003. The available assets are: . a risk-free bank credit and deposit, both available at the interest rate r-3%; shares of common stock of a company XYZ, with normally distributed returns; the expected return is = 9% and the volatility is = 25% Initially, both agents hold 50 shares of company X and no cash (a) Write down the optimization problem for both agents. write down the optimal demand for each agent, 21A and SIB, as a function of the share price P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts