Question: Consider a married couple that has two children under the age of 18, a combined income of $200,000 pays state and local taxes of $12,000,

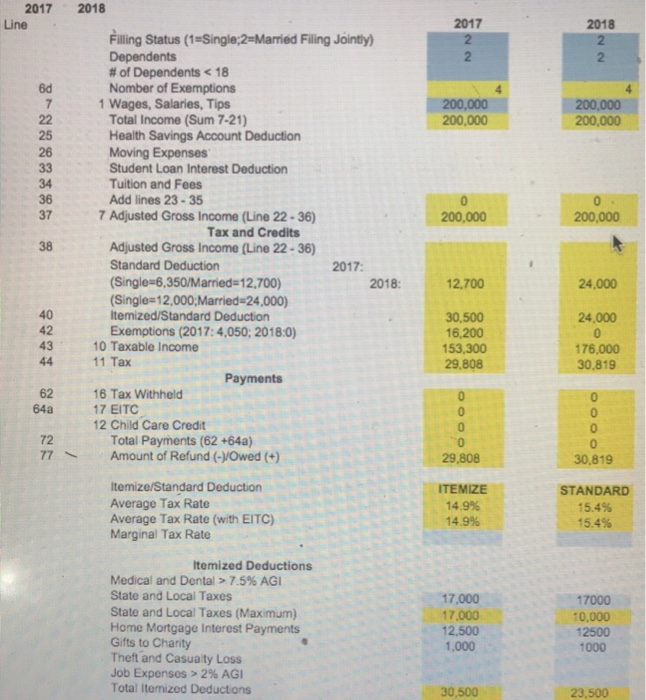

Consider a married couple that has two children under the age of 18, a combined income of $200,000 pays state and local taxes of $12,000, pays mortgage interest of $7,000 and contributes $2,000 a year to charities a) Based on this information determine their taxes for 2017 and 2018 using the spreadsheet Income Ta Income Taxes in 2017 and Income Taxes in 2018 b) For each year determine the after-tax "price" of 2017 2018 $1 of Charitable Contributions $1 of additional mortgage interest Esplain how you arrived at these amounts and why there is a difference in the two years. 2017 2018 Line 2017 2 2018 Filling Status (1-Single:2-Married Filing Jointy) Dependents # of Dependents 7.5% AGI State and Local Taxes State and Local Taxes (Maximum) Home Mortgage Interest Payments Gifts to Charity Theft and Casua ty Loss Job Expenses > 2% AGI Total Itemized Deductions 17,000 17.000 12,500 1,000 17000 10,000 12500 1000 30,500 23,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts