Question: Consider a Multi-Index Model (MIM) specification for the portfolio return: Ppt = Ap+Bp1Fit + Bp2F2t + Ept a) Derive the functional form for the variance

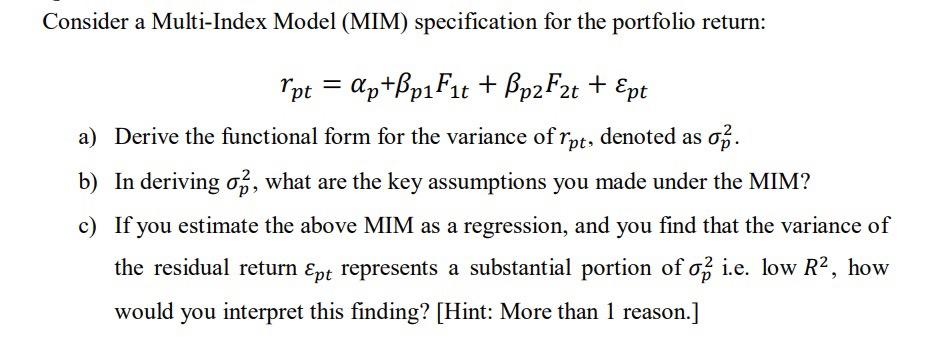

Consider a Multi-Index Model (MIM) specification for the portfolio return: Ppt = Ap+Bp1Fit + Bp2F2t + Ept a) Derive the functional form for the variance of rpt, denoted as op. b) In deriving op, what are the key assumptions you made under the MIM? c) If you estimate the above MIM as a regression, and you find that the variance of the residual return Ept represents a substantial portion of op i.e. low R, how would you interpret this finding? [Hint: More than 1 reason.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts