Question: Consider a neoclassical growth model with full depreciation t {log (et) - Aht} t=0 max {Ct, kt+1, it,ht=0 s.t. h Ct + it k'

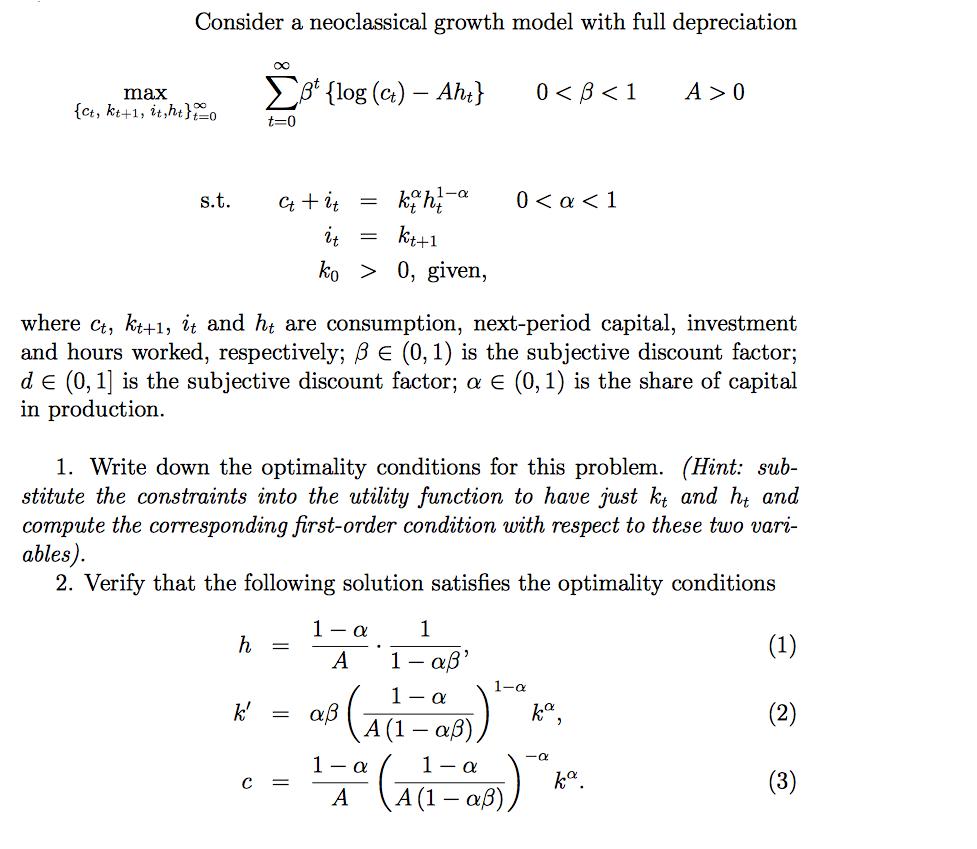

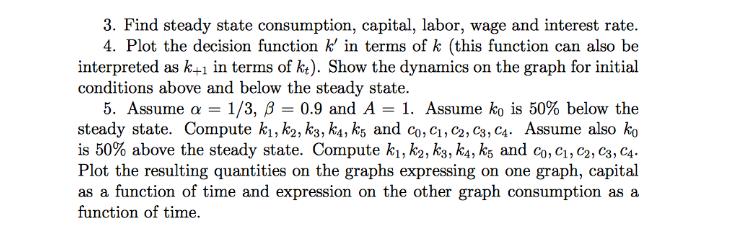

Consider a neoclassical growth model with full depreciation t {log (et) - Aht} t=0 max {Ct, kt+1, it,ht=0 s.t. h Ct + it k' koht it. = kt+1 ko > 0, given, = = = where Ct, kt+1, it and he are consumption, next-period capital, investment and hours worked, respectively; (0, 1) is the subjective discount factor; de (0, 1] is the subjective discount factor; a (0, 1) is the share of capital in production. C = 1. Write down the optimality conditions for this problem. (Hint: sub- stitute the constraints into the utility function to have just kt and he and compute the corresponding first-order condition with respect to these two vari- ables). 2. Verify that the following solution satisfies the optimality conditions - 1-a 1 A 1- 1 A (1 - a) 1 - a A 0 < a < 1 0 0 3 ka. (1) (2) (3) 3. Find steady state consumption, capital, labor, wage and interest rate. 4. Plot the decision function k' in terms of k (this function can also be interpreted as k+1 in terms of kt). Show the dynamics on the graph for initial conditions above and below the steady state. 5. Assume a = 1/3, 3= 0.9 and A = 1. Assume ko is 50% below the steady state. Compute k, k2, k3, k4, k5 and Co, C1, C2, C3, C4. Assume also ko is 50% above the steady state. Compute k, k2, k3, k4, k5 and Co, C1, C2, C3, C4. Plot the resulting quantities on the graphs expressing on one graph, capital as a function of time and expression on the other graph consumption as a function of time.

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Here are the solutions 1 The optimality conditions are a Marginal benefit of consumption equals marg... View full answer

Get step-by-step solutions from verified subject matter experts