Question: Consider a new product development project. In the current year (year 0) and the first year (year 1), you invest on the project. The following

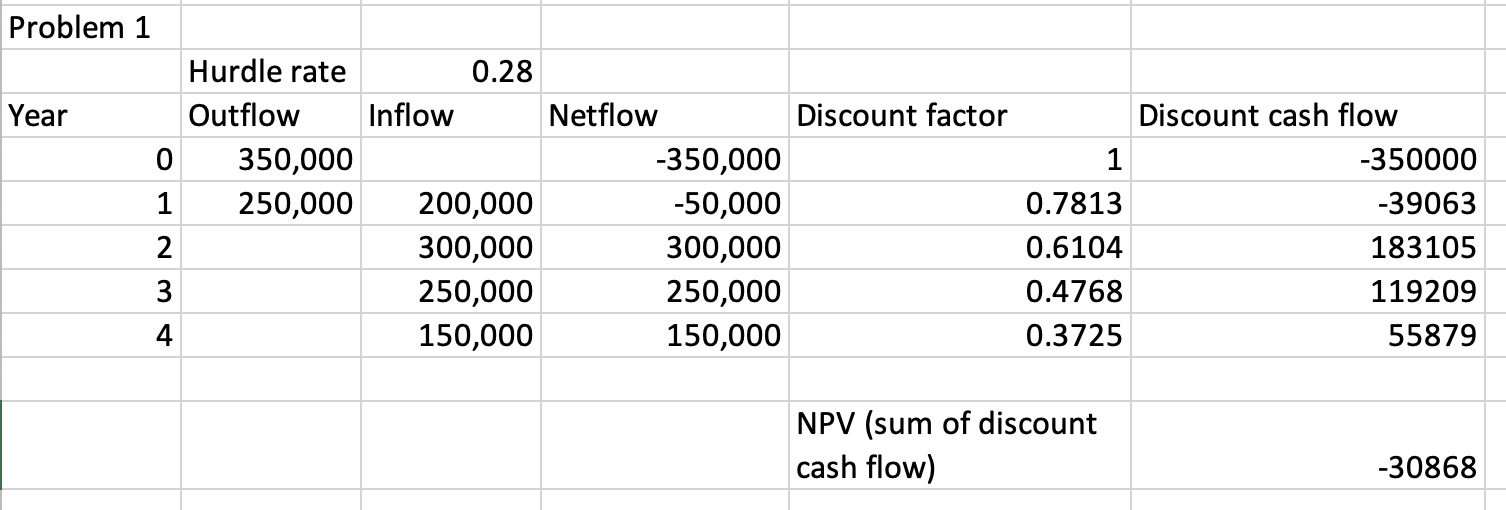

Consider a new product development project. In the current year (year 0) and the first year (year 1), you invest on the project. The following four years (year 1, 2, 3, and 4) you expect some additional profit (inflows) from this new product. Hurdle rate (Discount rate) is expected to be 0.28 for the entire time.

Cash flows (inflow/outflow) are given in the following tables:

Question: What should the cash inflow in year 4 be in order to break-even (NPV=0)? use GOAL SEEK function in Excel (you can Google it to see how it works).

Problem 1 Hurdle rate 0.28 Year Outflow Inflow Netflow Discount factor 0 350,000 -350,000 1 250,000 200,000 -50,000 2 300,000 300,000 3 250,000 250,000 4 150,000 150,000 Discount cash flow 1 -350000 0.7813 -39063 0.6104 183105 0.4768 119209 0.3725 55879 NPV (sum of discount cash flow) -30868

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts