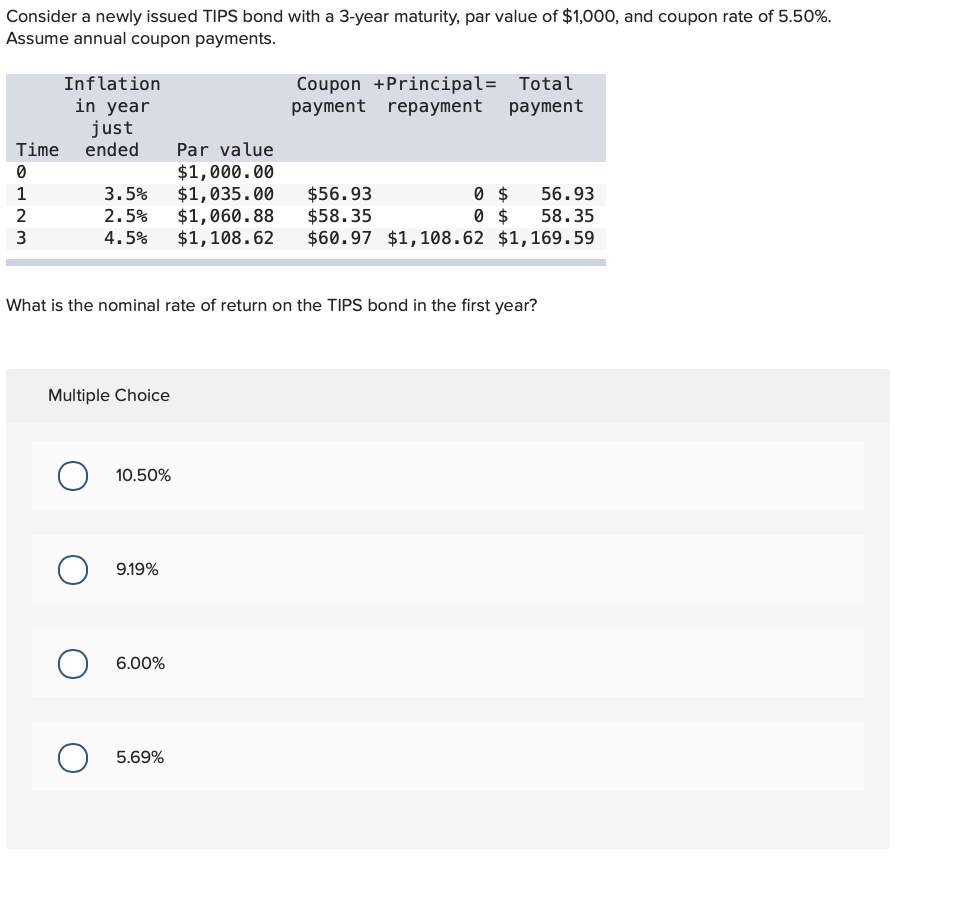

Question: Consider a newly issued TIPS bond with a 3-year maturity, par value of $1,000, and coupon rate of 5.50%. Assume annual coupon payments. Inflation in

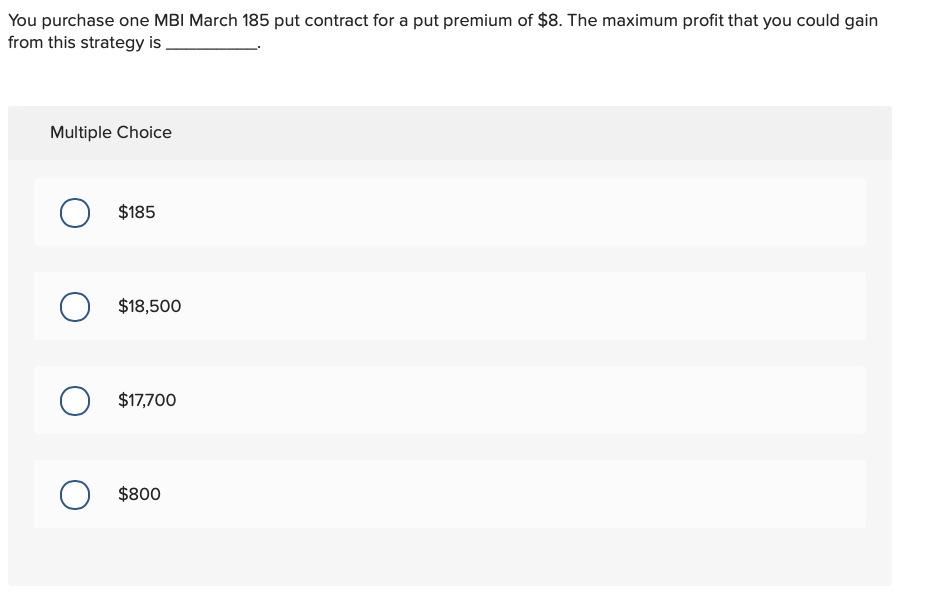

Consider a newly issued TIPS bond with a 3-year maturity, par value of $1,000, and coupon rate of 5.50%. Assume annual coupon payments. Inflation in year Coupon +Principal= Total payment repayment payment just ended Time 0 1 2 3 3.5% 2.5% 4.5% Par value $1,000.00 $1,035.00 $1,060.88 $1, 108.62 $56.93 0 $ 56.93 $58.35 0 $ 58.35 $60.97 $1,108.62 $1,169.59 What is the nominal rate of return on the TIPS bond in the first year? Multiple Choice 10.50% 9.19% O O 6.00% 5.69% O You purchase one MBI March 185 put contract for a put premium of $8. The maximum profit that you could gain from this strategy is Multiple Choice O $185 O $18,500 O $17,700 O $800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts