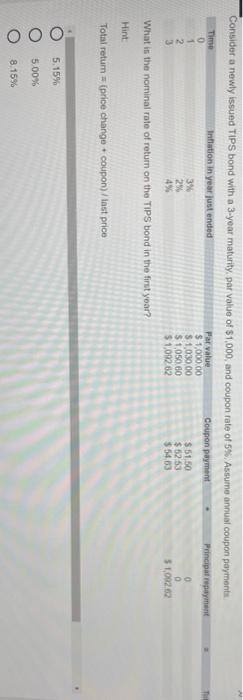

Question: Consider a newly issued TIPS bond with a 3-year maturity, par value of $1,000, and coupon rate of 5%. Assume annual coupon payments Time Inflation

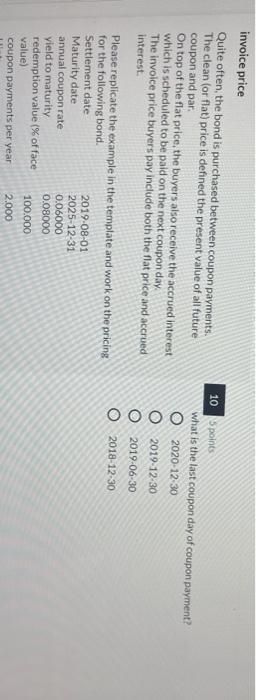

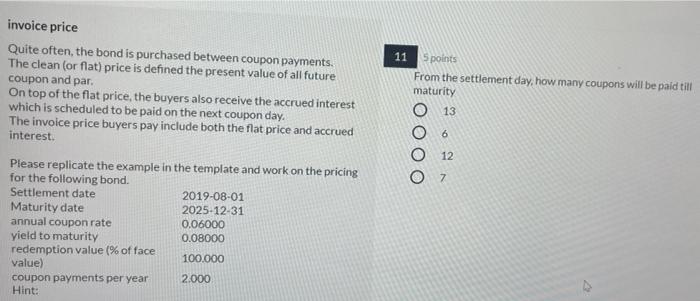

Consider a newly issued TIPS bond with a 3-year maturity, par value of $1,000, and coupon rate of 5%. Assume annual coupon payments Time Inflation in year just ended Par value 0 Coupon payment Principal payment $ 1,000.00 1 3% $ 1,03000 $ 51,50 0 2 29 $ 1.050.00 $ 52 53 0 3 4% $1.002.02 51,092 Wrist in the nominal rate of return on the TIPS bond in the first year? Hint Total retum = (price change coupon) /inst price 354 5.15% 5.00% 8.15% invoice price Quite often, the bond is purchased between coupon payments. The clean (or flat) price is defined the present value of all future coupon and par On top of the flat price, the buyers also receive the accrued interest which is scheduled to be paid on the next coupon day The invoice price buyers pay include both the flat price and accrued interest. Please replicate the example in the template and work on the pricing for the following bond. Settlement date 2019-08-01 Maturity date 2025-12-31 annual coupon rate 0.06000 yield to maturity 0.08000 redemption value (% of face 100.000 value) coupon payments per year 2.000 10 5 points what is the last coupon day of coupon payment? O 2020-12-30 2019-12-30 O 2019-06-30 2018-12-30 11 points From the settlement day, how many coupons will be paid till maturity 13 6 invoice price Quite often, the bond is purchased between coupon payments. The clean (or flat) price is defined the present value of all future coupon and par On top of the flat price, the buyers also receive the accrued interest which is scheduled to be paid on the next coupon day. The invoice price buyers pay include both the flat price and accrued interest. Please replicate the example in the template and work on the pricing for the following bond. Settlement date 2019-08-01 Maturity date 2025-12-31 annual coupon rate 0.06000 yield to maturity 0.08000 redemption value (% of face 100.000 value) coupon payments per year 2.000 Hint: 12 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts