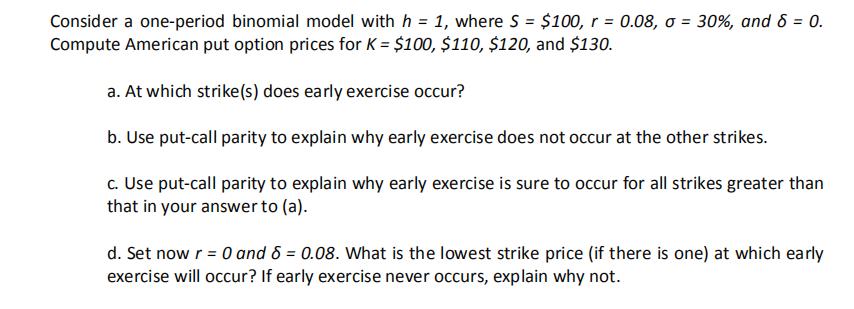

Question: = = Consider a one-period binomial model with h = 1, where s = $100, r = 0.08, o = 30%, and 6 = 0.

= = Consider a one-period binomial model with h = 1, where s = $100, r = 0.08, o = 30%, and 6 = 0. Compute American put option prices for K = $100, $110, $120, and $130. a. At which strike(s) does early exercise occur? b. Use put-call parity to explain why early exercise does not occur at the other strikes. c. Use put-call parity to explain why early exercise is sure to occur for all strikes greater than that in your answer to (a). d. Set now r = 0 and 8 = 0.08. What is the lowest strike price (if there is one) at which early exercise will occur? If early exercise never occurs, explain why not. = = Consider a one-period binomial model with h = 1, where s = $100, r = 0.08, o = 30%, and 6 = 0. Compute American put option prices for K = $100, $110, $120, and $130. a. At which strike(s) does early exercise occur? b. Use put-call parity to explain why early exercise does not occur at the other strikes. c. Use put-call parity to explain why early exercise is sure to occur for all strikes greater than that in your answer to (a). d. Set now r = 0 and 8 = 0.08. What is the lowest strike price (if there is one) at which early exercise will occur? If early exercise never occurs, explain why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts