Question: Consider a one-step binomial tree on stock with a current price of $60 that can go either up to $70 or down to $50 in

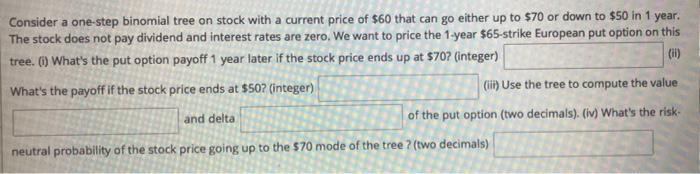

Consider a one-step binomial tree on stock with a current price of $60 that can go either up to $70 or down to $50 in 1 year. The stock does not pay dividend and interest rates are zero, We want to price the 1-year $65-strike European put option on this tree. What's the put option payoff 1 year later if the stock price ends up at $707 (integer) (11) What's the payoff if the stock price ends at $50? (integer) (1) Use the tree to compute the value and delta of the put option (two decimals). (i) What's the risk neutral probability of the stock price going up to the 570 mode of the tree ? (two decimals)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts