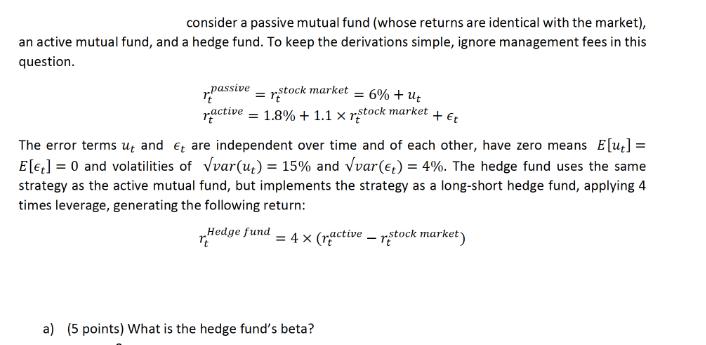

Question: consider a passive mutual fund (whose returns are identical with the market), an active mutual fund, and a hedge fund. To keep the derivations

consider a passive mutual fund (whose returns are identical with the market), an active mutual fund, and a hedge fund. To keep the derivations simple, ignore management fees in this question. passive =rstock market = 6% + Ut ractive = 1.8% +1.1 X rstock market + Et The error terms u, and are independent over time and of each other, have zero means E[ut] = E[] = 0 and volatilities of var(u) = 15% and var(e) = 4%. The hedge fund uses the same strategy as the active mutual fund, but implements the strategy as a long-short hedge fund, applying 4 times leverage, generating the following return: Hedge fund TE = 4x (ractive - stock market) a) (5 points) What is the hedge fund's beta? b) (5 points) What is the hedge fund's volatility? c) (5 points) What is the hedge fund's alpha?

Step by Step Solution

3.61 Rating (165 Votes )

There are 3 Steps involved in it

a To calculate the hedge funds beta we need to determine the sensitivity of the hedge funds returns to the market returns The beta coefficient measure... View full answer

Get step-by-step solutions from verified subject matter experts