Question: Consider a perfectly competitive market with Market demand function: Qd = 1000 - 2P Market supply function: Q* = 2P a. Suppose there is

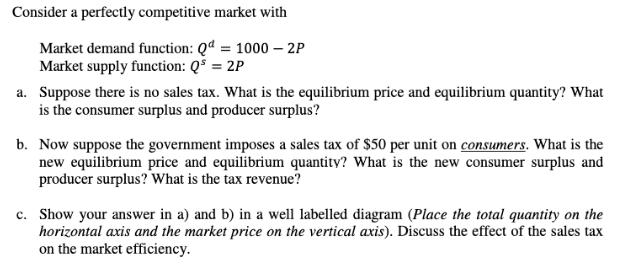

Consider a perfectly competitive market with Market demand function: Qd = 1000 - 2P Market supply function: Q* = 2P a. Suppose there is no sales tax. What is the equilibrium price and equilibrium quantity? What is the consumer surplus and producer surplus? b. Now suppose the government imposes a sales tax of $50 per unit on consumers. What is the new equilibrium price and equilibrium quantity? What is the new consumer surplus and producer surplus? What is the tax revenue? c. Show your answer in a) and b) in a well labelled diagram (Place the total quantity on the horizontal axis and the market price on the vertical axis). Discuss the effect of the sales tax on the market efficiency.

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

To solve this lets go through each part stepbystep a Equilibrium without Sales Tax Equilibrium Price ... View full answer

Get step-by-step solutions from verified subject matter experts