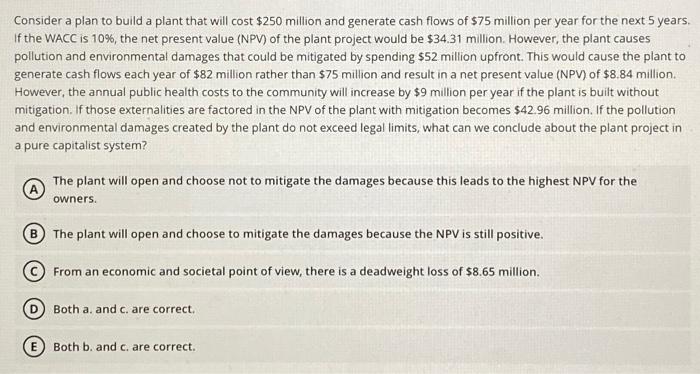

Question: Consider a plan to build a plant that will cost $250 million and generate cash flows of $75 million per year for the next 5

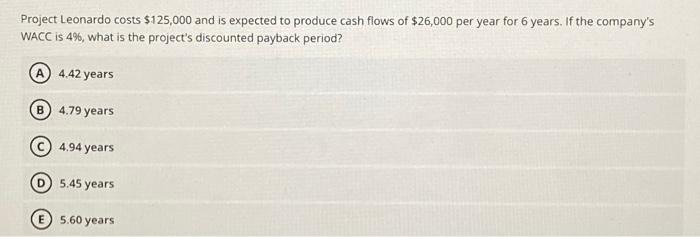

Consider a plan to build a plant that will cost $250 million and generate cash flows of $75 million per year for the next 5 years. If the WACC is 10%, the net present value (NPV) of the plant project would be $34.31 million. However, the plant causes pollution and environmental damages that could be mitigated by spending $52 million upfront. This would cause the plant to generate cash flows each year of $82 million rather than $75 million and result in a net present value (NPV) of $8.84 million. However, the annual public health costs to the community will increase by $9 million per year if the plant is built without mitigation. If those externalities are factored in the NPV of the plant with mitigation becomes $42.96 million. If the pollution and environmental damages created by the plant do not exceed legal limits, what can we conclude about the plant project in a pure capitalist system? The plant will open and choose not to mitigate the damages because this leads to the highest NPV for the owners. (B) The plant will open and choose to mitigate the damages because the NPV is still positive. (C) From an economic and societal point of view, there is a deadweight loss of $8.65 million. (D) Both a. and c. are correct. (E) Both b. and c. are correct. Project Leonardo costs $125,000 and is expected to produce cash flows of $26,000 per year for 6 years. If the company's WACC is 4%, what is the project's discounted payback period? 4.42 years (B) 4.79 years (C) 4.94 years (D) 5.45 years 5.60 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts