Question: Consider a position in a 0.45-year zero-coupon bond. Cashflow mapping is performed on this bond against a standard 3-month zero-coupon bond (with bond price volatility

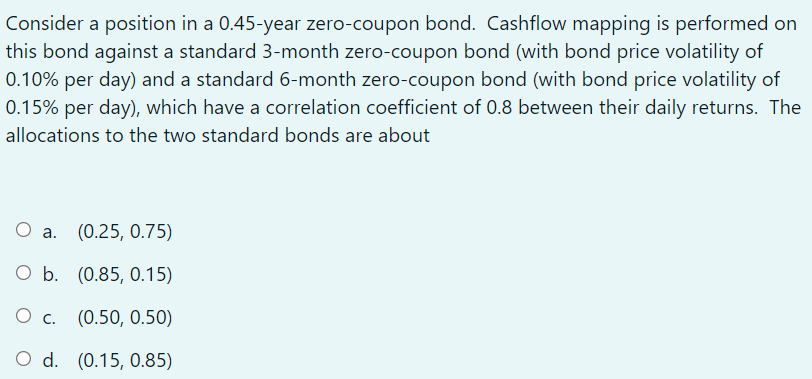

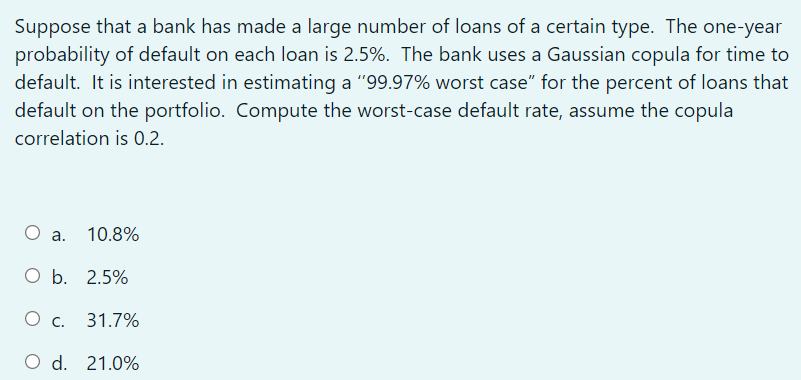

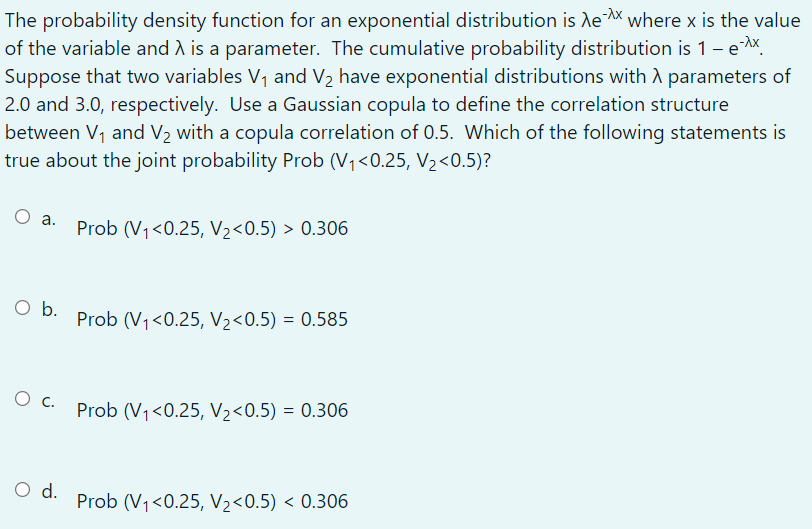

Consider a position in a 0.45-year zero-coupon bond. Cashflow mapping is performed on this bond against a standard 3-month zero-coupon bond (with bond price volatility of 0.10% per day) and a standard 6-month zero-coupon bond (with bond price volatility of 0.15% per day), which have a correlation coefficient of 0.8 between their daily returns. The allocations to the two standard bonds are about O a. (0.25, 0.75) O b. (0.85, 0.15) O c. (0.50, 0.50) O d. (0.15, 0.85) Suppose that a bank has made a large number of loans of a certain type. The one-year probability of default on each loan is 2.5%. The bank uses a Gaussian copula for time to default. It is interested in estimating a "99.97% worst case" for the percent of loans that default on the portfolio. Compute the worst-case default rate, assume the copula correlation is 0.2. O a. 10.8% O b. 2.5% O c. 31.7% O d. 21.0% The probability density function for an exponential distribution is de-Ax where x is the value of the variable and 1 is a parameter. The cumulative probability distribution is 1 - ex. Suppose that two variables V, and V2 have exponential distributions with a parameters of 2.0 and 3.0, respectively. Use a Gaussian copula to define the correlation structure between V1 and V2 with a copula correlation of 0.5. Which of the following statements is true about the joint probability Prob (V4 0.306 O b. Prob (V1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts