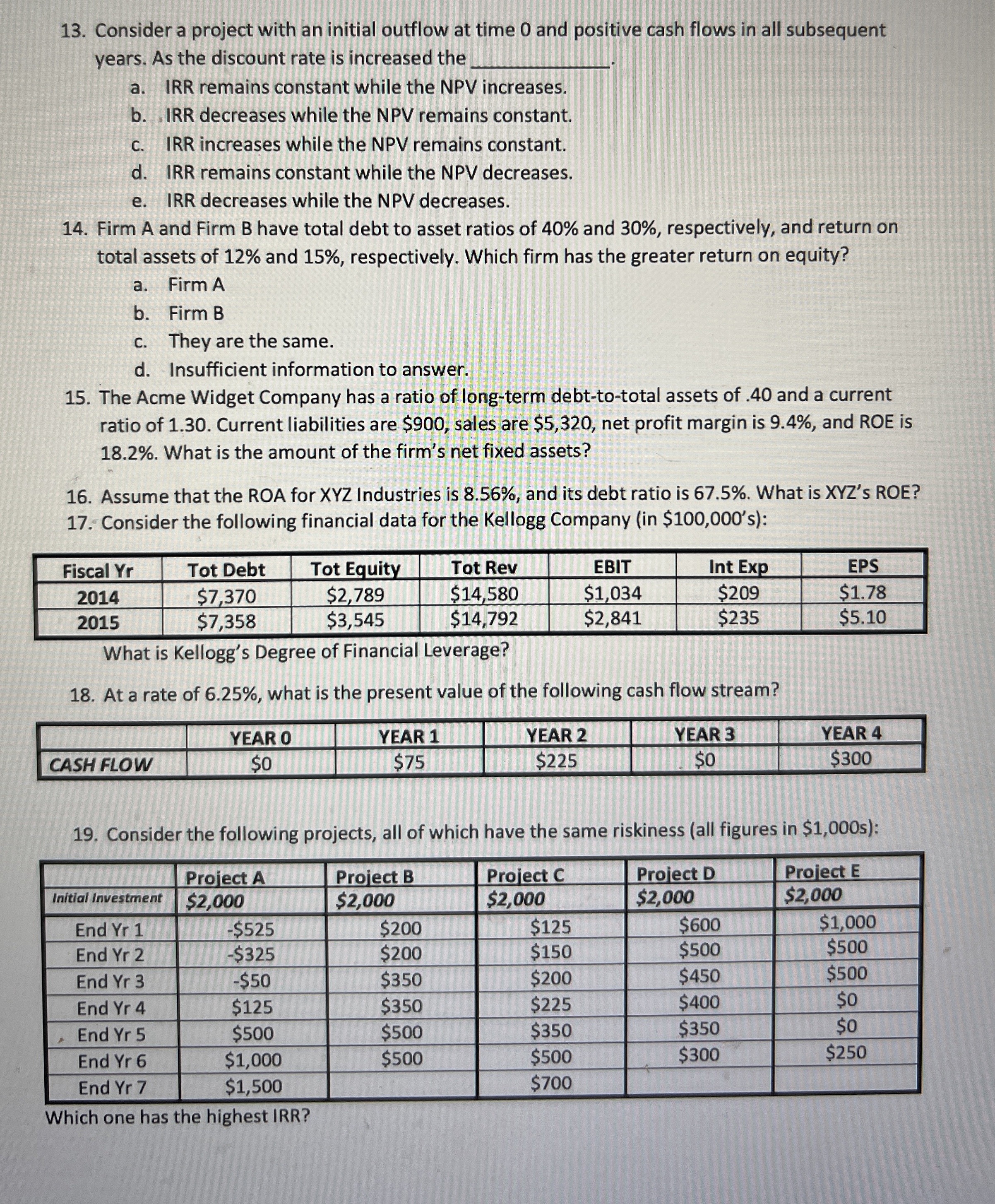

Question: Consider a project with an initial outflow at time 0 and positive cash flows in all subsequent years. As the discount rate is increased the

Consider a project with an initial outflow at time and positive cash flows in all subsequent

years. As the discount rate is increased the

a IRR remains constant while the NPV increases.

b IRR decreases while the NPV remains constant.

c IRR increases while the NPV remains constant.

d IRR remains constant while the NPV decreases.

e IRR decreases while the NPV decreases.

Firm A and Firm B have total debt to asset ratios of and respectively, and return on

total assets of and respectively. Which firm has the greater return on equity?

a Firm A

b Firm B

c They are the same.

d Insufficient information to answer.

The Acme Widget Company has a ratio of longterm debttototal assets of and a current

ratio of Current liabilities are $ sales are $ net profit margin is and ROE is

What is the amount of the firm's net fixed assets?

Assume that the ROA for Industries is and its debt ratio is What is XYZs ROE?

Consider the following financial data for the Kellogg Company in $s:

What is Kellogg's Degree of Financial Leverage?

At a rate of what is the present value of the following cash flow stream?

Consider the following projects, all of which have the same riskiness all figures in $ s:

Which one has the highest IRR?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock