Question: Consider a project with the following data: The 5-year project requires equipment that costs $80,000. If undertaken, the shareholders will contribute $20,000 cash and borrow

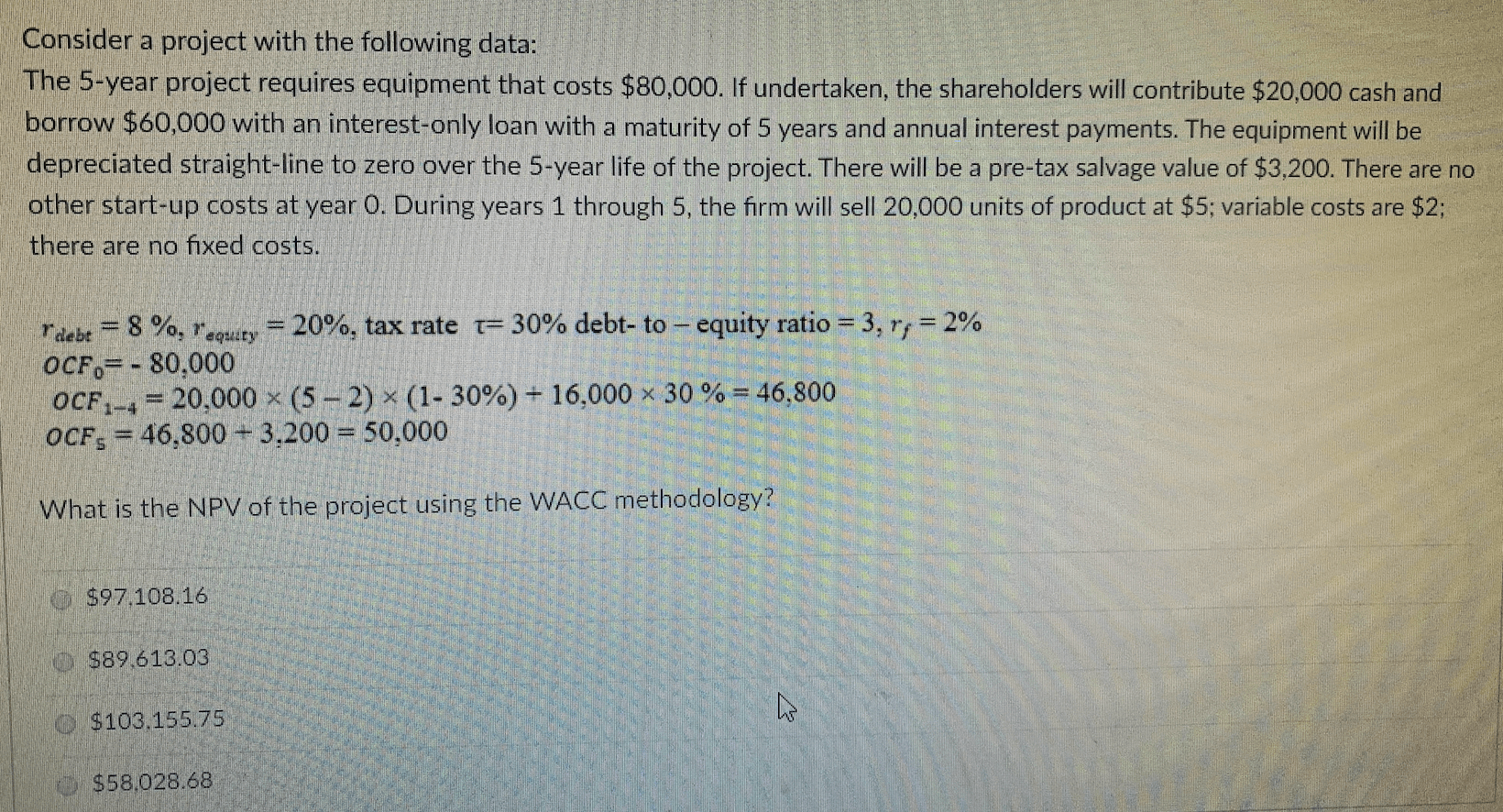

Consider a project with the following data: The 5-year project requires equipment that costs $80,000. If undertaken, the shareholders will contribute $20,000 cash and borrow $60,000 with an interest-only loan with a maturity of 5 years and annual interest payments. The equipment will be depreciated straight-line to zero over the 5-year life of the project. There will be a pre-tax salvage value of $3,200. There are no other start-up costs at year 0. During years 1 through 5, the firm will sell 20,000 units of product at $5; variable costs are $2; there are no fixed costs. debe = 8 %, requity = 20%, tax rate t= 30% debt-to - equity ratio = 3, r; = 2% OCF.= -80,000 OCF-4 = 20,000 (5-2) x (1-30%) + 16,000 x 30 % = 46,800 OCFs = 46,800 + 3.200 = 50,000 What is the NPV of the project using the WACC methodology? $97.108.16 $89.613.03 N $103.155.75 $58.028.68

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts