Question: Consider a put contract on a T-bond with an exercise price of 103 12:32. The contract represents $100,000 of bond principal and had a premium

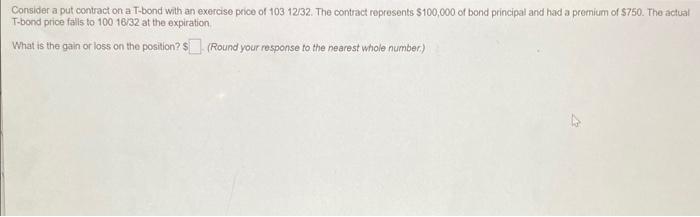

Consider a put contract on a T-bond with an exercise price of 103 12:32. The contract represents $100,000 of bond principal and had a premium of 5750. The actual T-bond price falls to 100 16/32 at the expiration, What is the gain or loss on the position? $(Round your response to the nearest whole number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts